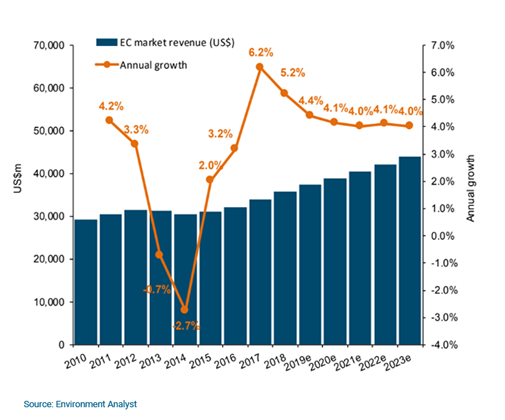

The global market for environmental consulting (EC) services increased 5.2% during 2018 to reach a record value of $35.8bn (£27.6bn), according to the latest research report published by Environment Analyst. Expectations are that 2019 and 2020 will be slightly more restrained with increases in the region of 4-4.5% given the slowing global economy and increasing risk of recession in mature markets such as the US and UK.

Fig 1: Global EC market revenues and growth, 2010-2023e

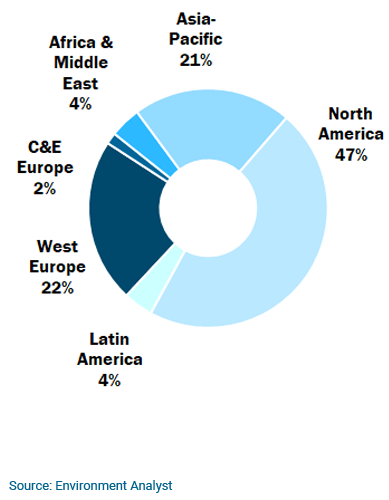

The fully updated and expanded edition of our annual Global Environment Consulting Strategies & Market Assessment report indicates that geographically growth is being driven by strong demand in the dominant North American region, where EC market revenues grew by 7.5% in 2018, primarily reflecting opportunities linked to infrastructure investment, climate resiliency, disaster recovery/planning and environmental restoration (in the wake of a series of natural disasters) and bullish government markets. However, the second-biggest region - Western Europe - saw a marked slowdown, with growth all but halving to 3.1% compared to the previous year, whilst there was also deceleration in Asia Pacific at 4.1%.

Fig 2: Global EC market by region, 2018

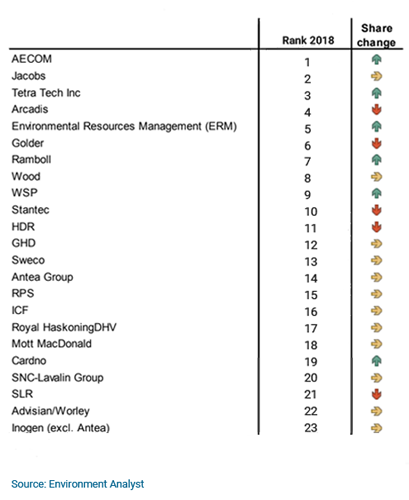

Environment Analyst bases its market estimates primarily on the performance and dynamics of 23 leading international EC players (the ‘Global 23’), which together account for an approximate 44% share of the global market as a whole. They are collectively responsible for servicing some 239,000 EC contracts per year, through a total EC staff contingent of c89,000 (FTE). These companies (and their legacy acquired firms) have grown their aggregated EC revenues by over 50% during the past decade. Significant M&A activity allowed them to outperform the market as a whole in 2018, with their EC revenue total increasing by 6.6% year-on-year, up slightly on the 6.4% they achieved the prior year.

Yet despite their continued efforts to consolidate, only three firms hold a market share in excess of 3% - namely AECOM, Jacobs and Tetra Tech - with little change in the trio’s dominance from the previous year. Arcadis, ERM, Golder, Ramboll, Wood, WSP and Stantec complete the top ten, which together have almost doubled their total market share since 2010 to just under 35% through a combination of acquisitive and organic growth, as they spearhead the globalisation of the environmental consulting services sector.

Fig 3: Global EC market rankings, 2018 (the 'Global 23')

WSP notably moved up two spaces in this year’s rankings to ninth place, having ranked 22nd just five years ago. The Canadian multidisciplinary consulting player’s step up has been aided by the $400m acquisition of the US-based professional services firm Louis Berger in 2018 which boosted its North American environmental standing, whilst the EC practice also benefited from strong infrastructure-related demand in both the UK and Australia.

Based on a breakdown of the Global 23’s aggregate revenues, EA finds that infrastructure & development work saw a massive 46% hike year-on-year for in 2018, accounting for just over 17% of total EC revenues. Work for government & regulators also saw good growth of 6.6% for the market leaders, which derive 31% of their revenues from the public sector overall. However, work in support of energy & utility firms (representing 22% of their total) took a downward dive with growth at -8.7% year-on-year, indicative of the ongoing uncertainty and price volatility affecting the hydrocarbons industry in particular.

In terms of EC service areas, the fastest-growing major discipline as indicated by the Global 23 is impact assessment, which saw a 23% increase in 2018 to account for almost a fifth of total revenues - linking to the major infrastructure investment spends seen across many key markets. Impact assessment ranks third overall behind contaminated site assessment and water and waste management, which saw respective growth rates of 3.9% and 6.1%. The two other major work areas assessed in the report - climate change & energy and environmental management, compliance & due diligence - saw more modest increases among the cohort this year at c2-3%.

The unparalleled industry research data and insight presented in this report points to some notable changes in terms of the most successful business models active in the EC space. Editorial Director of EA's Global Market Intelligence Service and co-author of the report, Liz Trew, explains: "Our analysis suggests that the global EC market has broadly been in a recovery and resurging period from 2015-19 coming out of the commodity super-cycle down dip. During this time generally the smaller environmental specialist players such as Golder, ERM and SLR outperformed the wider market, whilst the large-scale integrated and multidisciplinary service providers struggled to grow much organically; however, the latest year's crop of data suggests that the large integrated firms are now having their day and achieving much stronger organic EC growth rates.

"This we believe reflects not only the strong infrastructure and government markets - particularly in North America - which invariably favour the bigger full-service players, but also the fruits of some major M&A deals and management restrategisation for many firms within this category, as well as the huge investments seen in technology-enabled solutions amongst the likes of Aecom, Jacobs, Wood et al. It underlines that digital and better leadership focus are increasingly critical differentiators in the environmental services space," Trew states.

Based on Environment Analyst’s forecast model, the global EC sector is expected to grow by 23% - or by an average of 4.1% per annum - to 2023. This would see the market totalling approximately $44bn, with an additional c$8bn in new market space created over the next five years. Growth in climate change & energy services is expected to outstrip other core EC disciplines as consultants support their clients in navigating the energy transition and more ambitious national greenhouse gas emissions reduction targets.

Trew comments: "Our forecast model is based on a fairly cautious projection factoring in the slowing global economic growth indications and worries about the US in particular falling into recession. But EA’s unique EC intensity analysis by region really serves to highlight the huge growth potential of this space particularly as developing economies such as China move increasingly towards maturity in their environmental legislative framework and governance."

"And as general awareness amongst stakeholders - across industry, the public and within government alike - of the urgent need to act now to prevent further environmental degradation, biodiversity loss and climate change has never been greater, it will be interesting to see which EC firms rise to the challenge of global sustainability leadership," she adds.

Download further supporting charts and graphics here

-----

Subscribers were emailed password and download details for the 170-page Global Environment Consulting Strategies & Market Assessment report - and also for the accompanying Competitor Analysis report (all part of EA’s 2019/20 Global Market Intelligence Service series) - in December.

For queries about accessing this report or any others from Environment Analyst, please contact the sales team on tel: +44 (0)203 637 2191 and email: sales@environment-analyst.com. For editorial enquiries please contact Liz Trew on email: liz@environment-analyst.com, tel: (0)1743 818 2106