Environment Analyst today publishes the findings of the COVID-19 Industry Impacts & Outlook Survey II (UK & Ireland edition), undertaken in November. The report highlights the extent to which this pandemic has disrupted the environmental services industry and its workforce over the last twelve months.

Encouragingly, the survey suggests an emphatic improvement in business outlook when compared to our last survey in June. Back then when we first canvassed our audience – largely consisting of business leaders, executives and practitioners active in the environmental professional services community – national lockdowns and economic headwinds had created much uncertainty for the industry. With no vaccine in sight, the outlook was dire: a -10.4% dip in average revenues in 2020, followed by an ongoing decline of -4.6% in 2021.

However, our latest survey shows a dramatic swing in business confidence as lockdowns have eased, virtual solutions accepted, projects continue apace and, thankfully, the emergence of viable vaccines to COVID-19. As a result respondents anticipate revenues will dip by just -2.9% in 2020, and that growth will return in 2021 with an average increase of 2.7%. What a difference five months can make.

"This report provides business leaders with much needed reassurance and cause for optimism after what has certainly been a challenging year," said Ross Griffiths, content director at Environment Analyst. "Once again, our analysis shows the environmental services industry has proved itself capable of adapting and prospering in the most difficult of circumstances."

"This industry – and all the environmental and sustainability expertise it harnesses – is now perfectly placed to help the UK move towards a green recovery, and ‘build back better’. In doing so, it will further demonstrate the industry’s value proposition to clients and stakeholders around the world."

With 149 individuals participating in the latest survey, the results provide business leaders, strategists and practitioners with much-needed intelligence heading into the new year. It uncovers the trends around cost saving initiatives, office reopening plans, remuneration levels, client sector activity and redundancies. It also highlights the opportunities within the environmental services industry and how these may translate into demand for environmental and sustainability services going forward.

The full survey results and analysis have just been published to EA Strategic Members and those who participated in the survey.

Strategic members can download the full report here

Key findings from our ‘COVID-19 Industry Impacts and Outlook Survey II: UK & Ireland’ report include:

Financial outlook for 2020 & 2021

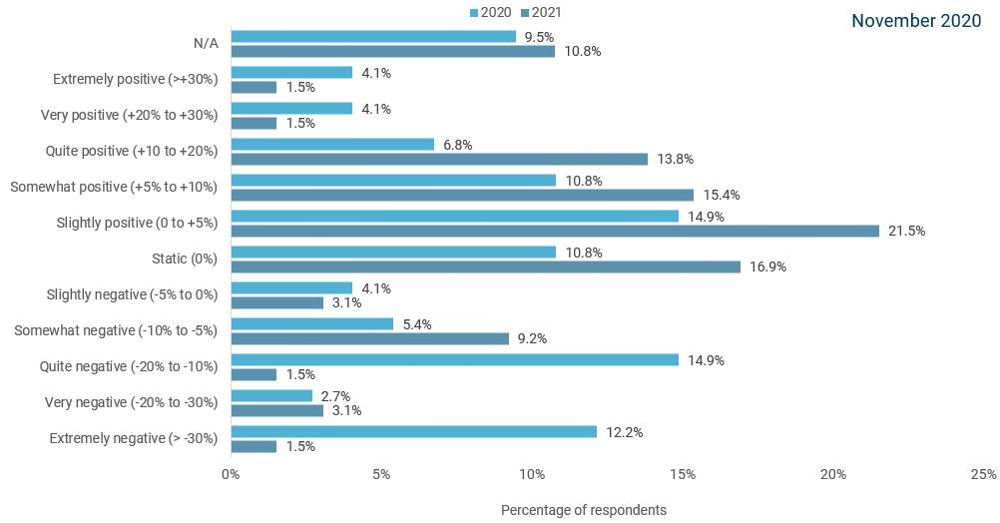

Figure 1 below illustrates the spread of survey responses on financial expectations in terms of (organic) revenue growth in 2020 and 2021. Respondents were certainly divided on the impacts of the pandemic on revenue growth in 2020. Two-fifths of respondents expect a decline to some extent, while two-fifths expect growth. Although the mean weighted average revenue growth for 2020 is expected to come in negative at -2.9% (median = 0%), this is a huge improvement from our June survey when growth was forecast at -10.4% (median = -15%). Interestingly, our global survey found average growth would be positive in 2020 (+1.3%), indicating the UK has been disproportionately affected by CV-19 when compared to other international markets.

Over half of respondents (54%) forecast growth to some degree in 2021, compared to just 10.1% in our June survey. Meanwhile just 18.5% foresee a decline in 2021, much improved from the 44% listed in June. As a result the mean weighted average of +2.7% (median 2.5%) will be a welcome relief to business leaders across the industry, and a huge improvement when compared to the June forecasts of -4.6% (median -2.5%). Our full report contains much more granular analysis of the revenue projections by company size but in general those from larger firms (>1,000 FTEs) are more cautious in their projections when compared to SMEs.

Fig 1. Revenue impact compared to previous year (Source EA UK CV-19 Industry Impacts & Outlook Survey II, Nov 2020)

Place of work trends

Around eight out of ten respondents report to be working from home (and the majority on a full-time basis) but there has been a movement to WFH part time. Around a fifth now say they are back in the office already, while an additional third are expected to return in the first half of next year. One-fifth think they won’t return to the office until the second half of the year, while another fifth are not expecting to return to an office at all. This matches up with the growing number of announcements from companies that they will be rationalising office space in 2021. While people worked on average one day a week from home prior to the crisis, respondents suggest their preference for 2021 would be a hybrid model, on average working from home 2.6 days per week. The survey also found work-related travel (for on-site and/or client visits) has been dramatically curtailed this year down to an average of 6.6 hours per week.

Working hours and evolving responsibilities/upskilling

Interestingly, a small proportion of respondents (15%) have reported an increase in average working hours compared to pre-COVID-19 - suggesting that the pandemic has had a negative impact on their work/life balance. However, this will be helping to keep utilisation rates perhaps unnaturally inflated. Over a quarter of respondents reported that they have taken on new responsibilities, particularly in project management and digital transformation, while two-fifths have used this year to upskill.

Project and client sector impacts

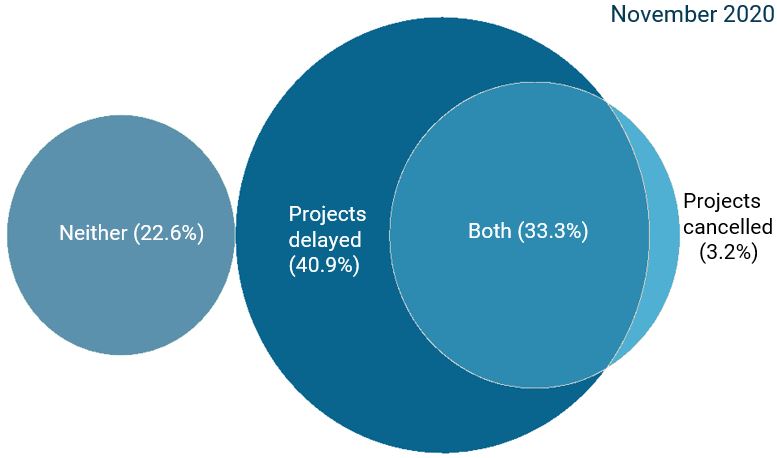

The vast majority of respondents said their work had been impacted by project delays (74%) and/or cancellations (36.5%) due to COVID-19, but 23% had experienced neither (Figure 2). When we asked members to indicate the trend in recent project pursuits across industry verticals there were some expected outcomes. Those sectors most impacted by national and local lockdowns such as retail, hospitality, aviation and residential construction were badly affected. Meanwhile, those verticals most aligned to the green industrial revolution and a sustainable recovery such as renewables, technology/communications and waste / recycling all performed well. The economic stimulus provided by the public sector is also yielding opportunities for our members.

Fig 2. Trends in project delays and cancellations (Source EA UK CV-19 Industry Impacts & Outlook Survey II, Nov 2020)

Remuneration trends and cost-saving measures

Most salaries fell in real terms in 2020, with 32% nominally down year on year, and 41% static (or down in real terms given inflation). On average salaries/bonus packages are reported to be nominally down year-on-year (with the full report providing data on remuneration changes across the industry and by company size). Other cost reduction initiatives commonly cited are staff working hour reductions (32%), office closures (25%) reduced budgets for continued professional development (23%) and enforced paid/annual leave (22%).

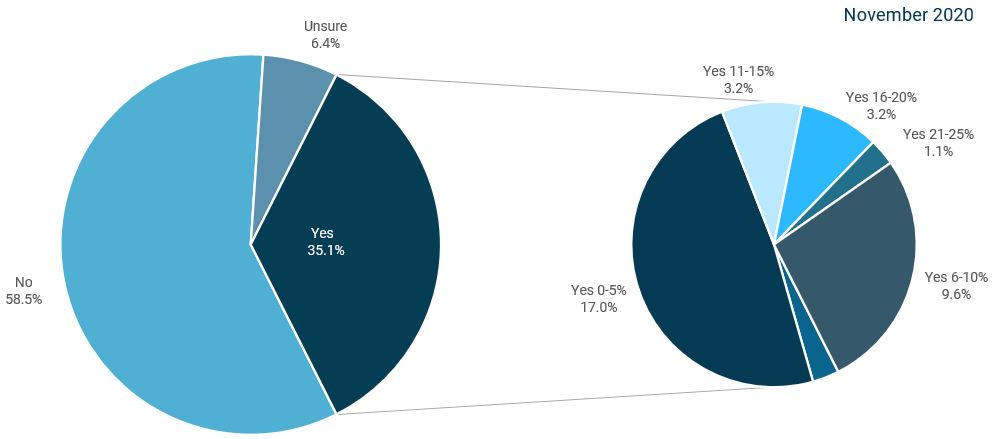

Layoffs and furloughs

Over a third of respondents reported job losses of some description in their team / organisation to date during 2020, much higher than the 13% reported in June for the first six months of the year. Ten percent of respondents indicated redundancies had been in the order of 6-10% at their organisation. The average weighted redundancy levels for 2020 were 2.7%, which is a remarkably small figure given the scale of the crisis. The UK Coronavirus Job Retention Scheme (CJRS) and Irish Employment Wage Subsidy Scheme (EWSS) have played a significant role in supporting firms in holding on to their core assets - their staff. Almost half of respondents stated the government’s financial support has been good.

Figure 3. Redundancies reported within organisations during 2020 (Source EA UK CV-19 Industry Impacts & Outlook Survey II, Nov 2020)

Build back better

Finally, members were clear they thought the coronavirus pandemic will serve to accelerate the transition to a more sustainable, low carbon future with 57% suggesting so. A third believe this unprecedented year, may well have served to expedite this transition by at least 3-5 years. Respondents were divided as to whether green recovery packages or economic stimulus plans – such as Boris Johnson’s £12bn ten-point plan, and £600bn four-year infrastructure spending spree – will benefit their organisation. Just under a third (32%) indicated it would, but 29% suggested not.

____

All survey participants and EA Strategic Members will be receiving an email giving access to the full set of our COVID-19 Industry Impacts & Outlook Survey II charts and analysis. If you are not a member but interested in obtaining a copy please contact Lisa Turner (lisa@environment-analyst.com)

A big thank you to all those who took part in our surveys this year.