After a punishing 2020, in which revenues dropped 11% on 2019 and adjusted profits before tax shrank by 64%, the global leadership team of UK-headquartered environmental and energy consultancy RPS might have been forgiven if they had retreated to lick their wounds. But CEO John Douglas remained decidedly upbeat for his latest analyst update, despite the harsh reality of a year that had forced 175 redundancies (about 3.5% of the workforce) and a further 200 employees still on either furlough, reduced hours, or reduced pay at the end of December 2020.

Gross revenues for 2020 came in at £542.1m ($751m), from £612.6m in FY19, and adjusted profit before tax (PBT) of £13.4m ($18.6m) from £37.4m. The most significant drops segmentally were in the North American business, which saw fee revenues down 15% to £39m, and in UK & Ireland consulting, also down 15% to £108m. Fees for the firm’s global energy segment were down 27% to £75.7m. The company announced it would not be issuing a dividend to shareholders.

Reasons for optimism can be hard to find in the face of sobering figures like these. The firm’s annual results statement makes a good attempt, highlighting the fact that, while the first half of 2020 was severely impacted by the pandemic, all business segments remained profitable for the year as a whole, and the second half "showed encouraging momentum and an improving fee trajectory". It also points out that by the fourth quarter, one or two regions – its services business in the UK and Netherlands, and Norway overall – were already seeing higher revenues than in the same period in 2019. Profitability was maintained for all regions but at a markedly lower level for all except Australia Asia Pacific (AAP), which saw an impressive 30% growth in PBT for 2020 and a 4% increase in revenues.

Another highlight was the fact that RPS’s investments in digital through 2018-19 had improved online client engagement and staff collaboration just in time to support rapid adaptation to the pandemic lockdowns. Still, there is no denying that a year like that takes the wind out of any sails; even more so when the ship has only recently set the bearing for a new course.

"We are proud to have preserved a lot of jobs and, in the process, retained capability and protected value"

RPS, Douglas reminded, has been through a period of reinvention, throwing off the mantle of its previous, conservative leadership (after Douglas took the helm in 2017, installing a new top team and company strategy in quick measure) and aligning itself with the imperatives of the post-carbon energy transition. This entailed not only the digital upgrade, but also the reshaping of the company’s energy portfolio to enhance its focus on renewables and to move its business philosophy from "diversity to density" (including the late 2020 sale of a specialist geology unit within the energy business to Petrostat).

Focus on cash and strategic priorities

Even while in transition, the company’s response to the initial shock of COVID-19 mirrored that of many others. It reached for the purse strings, quickly putting into place more disciplined billing, cash management, debt reduction and tax deferral measures. Also high on the priority list – again actions common among its peers – were determined efforts to invest in "people, clients and connectivity," which Douglas claims were successful and resulted in good levels of health, safety, and wellbeing – and as many jobs protected as was possible – throughout the year.

The impression is that these actions, combined with a strong exposure to public sector and private regulated clients – business from which remained healthy throughout – enabled RPS to keep its bearings despite the buffeting.

"We did a healthy job of management through COVID," said Douglas. "We had good health and safety outcomes and good wellbeing outcomes. The thing we are probably most proud of is we preserved a lot of jobs, and, in the process, retained capability and protected value. We are seeing revenue stabilised and quickly regrowing."

The enhanced recognition of the value of employees – especially in a company whose business model is founded on "hiring out our people’s time for more than we pay them and keeping the overheads low" – is a central theme to Douglas’s mission.

"When I took over in 2017 [the company was] grossly underinvested in HR and people practices; grossly underinvested in the brand, particularly the online brand; and grossly underinvested in technology" he told EA. "So, we invested all the way through 2018, 2019 in people, clients, and connectivity. We launched the new brand and put the new website up in ‘19 and so were in a position to sell online in ’20. That weighed down on margins. But we said very clearly to the markets at the end of ’19 that we’d see a return on that in ’20. And we got an absolutely huge return. Not in quite the way we expected. But we got through COVID pretty well, because we’d invested in hardware, in software and in training."

Client base mix is key

With that foundation in place in the nick of time, it is no surprise that there is a sense of achievement and perhaps relief on the part of the leadership team. Also gratifying was being able to fall back on the firm’s majority client base in government and regulated industry clients, which remained solid, providing more than 55% of fee revenues, and the promise of growing cross-sell opportunities into urban infrastructure (in Ireland in particular), natural resources (AAP and Norway) and sustainability (North America, UK & Ireland and Norway).

However, RPS’s exposure to the energy sector brought vulnerability, Douglas acknowledged. "There was still plenty of demand – it’s just hard to get out to the work, right?"

Retail, aviation and hospitality were also badly impacted, Cottrell added.

Practical environmental testing services took a hit too, because although the firm’s laboratories could still function, and in a COVID-safe manner, "people were reluctant to go and collect a sample and drop it off," explained Douglas. "There’s no lack of capacity to do the work and no lack of demand for the work, but in periods of strict lockdown, people are not doing sampling, so samples are not getting tested, and there’s a backlog, for example of asbestos testing. But we have done this dance before, especially in the UK. We know the labs will bounce back very quickly."

Cottrell and Douglas highlighted how the variation in government responses to the pandemic had had direct effects on business. In the northern hemisphere, which experienced several waves of lockdowns, the effects have been pronounced. In RPS’s AAP business, less so – which is reflected in the fee revenues for that region of £92.9m, up 4% on 2019.

ESG progress

One key area in which RPS has an element of catching up still to do – despite the heightened focus brought to it by COVID-19 – is ESG. The company has brought a new net zero proposition to its clients, but Douglas admits that its internal ESG journey is less clear. "You wouldn’t be the first person to observe that maybe the cobbler’s son is poorly shod," he remarked. "[Covid] has certainly forced us to look internally and lift our own standards. We don't produce much carbon ourselves – most of the impact we can have on decarbonisation is working with clients. But we still have to sort our own garbage, right? If you're serious about sustainability, you should do that.

"The other thing I would say is that ESG is also about the S and the G," he added. "All the things we're doing around good people practices go to the S; the fact that we're standout leaders in gender diversity, for example, goes to the S. We haven't perhaps linked to the ESG framework as well as we should, but I'd argue very strongly that good people practices, creating a performance-based meritocracy, is the platform for diversity and inclusion. We significantly lifted the game in the last three years; also, we are a much more transparent company than we were three or four years ago. We've helped our clients tell their story; but we also have strong story. Have we done as good a job as we should have in talking about our ESG credentials? Absolutely not."

The leadership team’s focus on people shone through in comments about the future, too.

"The thing that Judith and I have probably lost most sleep over: it’s not capex, it’s not dividends, it’s about getting the bank leverage to the point where we can make the hiring and reward decisions that we need to keep the business in good shape," revealed Douglas. "So that’s probably our first cab out of the rank: keep the talent you’ve got and put yourself in a position to hire more talent."

But that is not the only area where RPS is planning on investing for future growth.

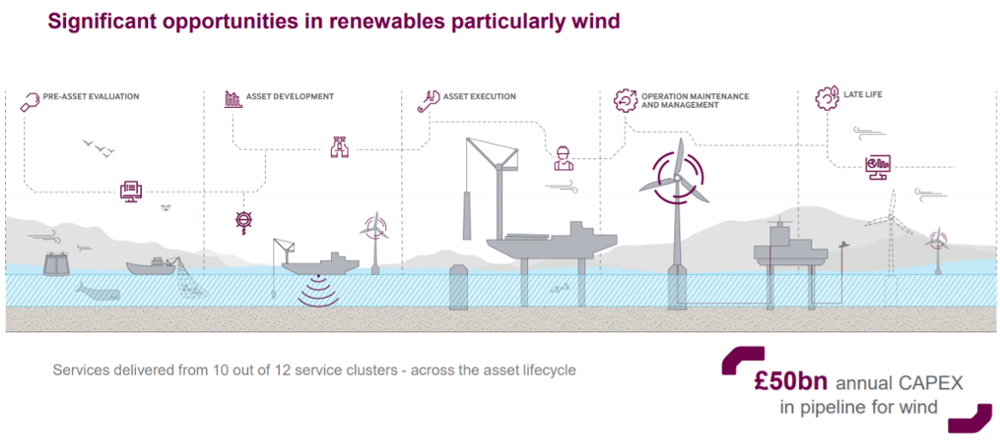

The firm’s drive is on organic expansion, particularly in Asia Pacific. 2020 saw the opening of two further offices in New Zealand and the establishment of a joint venture with Japan’s E&E Solutions, with a view to tapping into the rapidly growing Asian offshore wind market. "Organic growth is going to come very much from the renewables [sector], particularly from investment in offshore wind, and also in project management and transport infrastructure," said Cottrell.

"We still see small, bolt-on acquisitions being creative, but we are committed to organic growth," Douglas underlined.

(Source: RPS FY20 Results Presentation)