Climate change and net zero are two sides of the same coin and they are presenting business and industry and their specialist advisers with an unprecedented challenge. Adaptation, resilience, risk management and large scale, innovation-led carbon reduction are all factors that should be included for consideration as part of a ‘Build back better – build greener’ programme for recovery and growth – both in the UK and internationally.

Business-as-usual is not an option, speakers and panellists agreed on the first full day at this year’s Environment Analyst Business UK Summit on 22nd June. "There’s a tsunami of strategic and policy change coming our way," Ramboll’s UK managing director Philippa Spence told attendees at the virtual event. "Every consultant needs to understand some of these to help future proof our clients." In short climate change and sustainability had roared to the top of corporate agendas and this was putting environmental consultancy and the nature of services and advice provided under the spotlight.

The upshot, admitted another speaker, the avuncular Temple Group CEO Mark Southwood, was that the environmental & sustainability consulting profession needed to be more joined up and more collaborative in its approach. "We’ve got ten years to make some changes and we need to go beyond the rhetoric and deliver on that," he said.

"It’s the way we work together as a collective that will be so important" - Mark Southwood, Temple Group

Who gets the ESG work?

The context for this year’s Business Summit was a continuing shake-up in the sector and the opportunities presented by climate change and post-pandemic recovery. The elephant in the room, arguably, was ESG: what was its impact and why, thus far, weren’t environmental consultancies able to grasp a larger share of the market? In 2019, ESG accounted for just 4.7% of the UK environmental consultancy market, noted Environment Analyst content director Ross Griffiths, as part of a statistic-rich introduction to the day. In that year, he said, sector revenues from ESG and sustainability strategy services had increased by 5.1% to reach £88m, rising by a further 5.6% in 2020, with continuing expansion of the ESG market very much on the cards.

"It's unclear exactly why ESG has not yet translated into bigger gains," remarked Griffiths, but he noted that management consultancies were mopping up a large share of ESG work because of their C-suite penetration. Firms such as Boston Consulting Group, Bain & Co and McKinsey & Co were all reporting multiple projects and significant growth in the space, while ‘Big Four’ incumbent PwC has boldly announced it will recruit 100,000 specialist staff globally over the next five years to meet the growing demand for ESG advisory services (EA 21-Jun-21). Environmental specialists recognised that they had to lead by example and drive the professional services industry’s leadership role, said Griffiths, with the governance aspect of ESG presenting its own particular challenge.

Industry shake-up

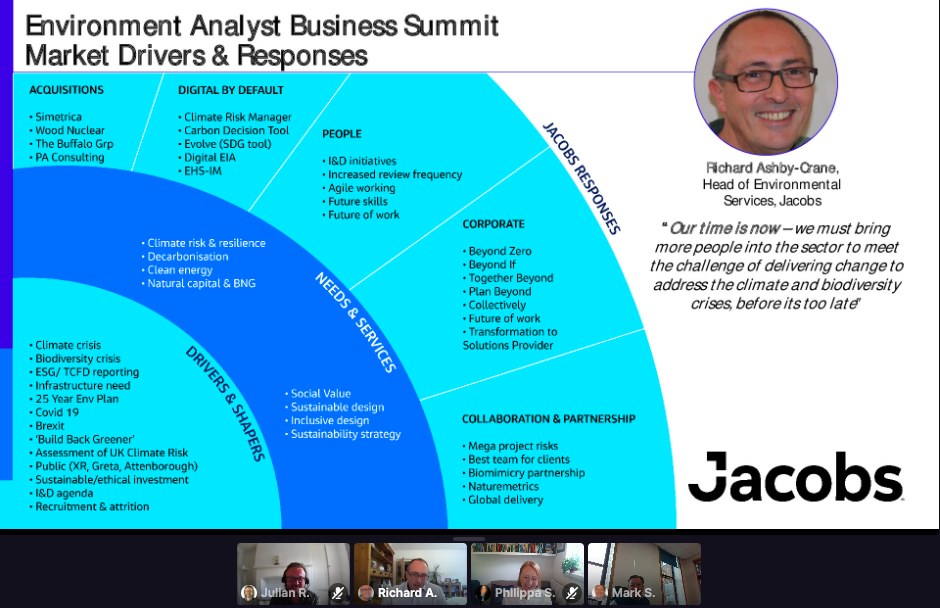

Against this backdrop, said Richard Ashby-Crane, senior director and head of environmental services at Jacobs, the industry shake-up was both inevitable and ongoing. The Jacobs response, he noted "is we are trying to transform ourselves from being an engineering consultancy to an innovations solutions provider" and that meant a series of acquisitions covering such key areas as energy, technology and, with the purchase of PA Consulting, management consulting and business transformation (EA 01-Dec-20).

"We’re driving our business to be ‘digital by default’ and we’re delivering through products as well as selling our time," added Ashby-Crane. This included the development of a new climate risk management tool to help clients with TCFD reporting and there was much more on the horizon. More generally, and with an echo of Mark Southwood’s emotive battle cry, he underscored, "if we do not collaborate now it will be too late". "We have this moment and we need to bring more people into the sector to meet the twin challenges of climate change and biodiversity." Jacobs revealed last month that it had launched a climate change course open to its entire c55,000-strong global workforce as part of efforts to embed green skills to respond to the climate crisis (EA 23-Jun-21).

In his keynote address, one of a number given since the EA Business Summit’s inception in 2015, Matthew Farrow, executive director of the Environmental Industries Commission, outlined four themes that were helping to shape the UK environmental industry sector. These were: environmental policy, notably the Environment Bill which is currently going through Parliament and should be enacted by the end of 2021; net zero targets which are gathering momentum in government and across different sectors; infrastructure, still the biggest driver in the environmental consultancy market; and the politics, which are being shaped by an acceptance of target setting and the imminent COP26 meeting in Glasgow.

"Overall," said Farrow "there’s a pretty decent policy framework emerging post-Brexit but enforcement is more of a concern (for example, in dealing with an area like contaminated land)." As for net zero, there was nothing wrong with the target-setting at government and industry sector level, but the ambition didn’t always match either the targets or the rhetoric.

Infrastructure still a key driver

Both Farrow and Griffiths highlighted the importance of infrastructure as a key driver for environmental services, and both agreed that this would continue to be the case. While the pandemic had led to an overall 2.5% decline in EC market revenues in 2020, this followed growth of £40m in impact assessment related infrastructure and development work the prior year which helped fuel the entire sector. And, according to Griffiths, "going forward robust EIAs will be more important than ever". Not far behind but with a full head of steam (not gas), climate change and energy work for environmental consultants grew by £28m as the UK became the first major economy to mandate for net zero by 2050 (EA 14-Jun-19).

Griffiths reflected that between 2013 and 2015 there had been considerable consolidation in the UK EC sector, which is now recovering from the double disruption of Brexit and the global pandemic. Another more recent spate of M&As coupled with growing private equity investment has arguably left the sector better prepared to weather the storm, and given the surge in areas such as ESG and climate change work there was plenty of cause for optimism all speakers agreed.

"There’s probably never been a better time to enter the environmental field," said Temple’s Mark Southwood. "It’s the way we work together as a collective that will be so important and we need to ensure that this is real and not just rhetoric."