Four in ten respondents to Environment Analyst’s ‘COVID-19 Industry Impacts and Outlook’ survey - which we ran online during the first three weeks of June - report their salary and bonus package has been reduced as a result of the coronavirus crisis. While, on average, a 9.3% contraction in revenues is expected for their companies this year, followed by a further 4.8% dip in 2021.

These were some of the headline findings from the global survey edition, the full results of which have just been published to EA Strategic Members (report download).

Members can download the full report here

With 263 individuals participating - including business leaders and practitioners - the survey illuminates many of the fundamental changes environmental & sustainability consulting professionals and their firms are facing as a result of the COVID crisis, and how it is expected to impact demand for services this year and next.

Key findings include:

- Personal work situation - eight out of ten respondents said they were now working from home, while only one in ten said there had been no changes to their work situation whatsoever as a result of CV-19 crisis. Forty percent indicated they were still able to undertake limited work ‘on-site’, while only 14% said on-site visits were not permitted at all.

- Upskilling and changed responsibilities - this came across as a strong feature of the crisis impact with around three-quarters (74%) saying they had undertaken some kind of retraining or upskilling during the crisis period. Commonly this involved: digital tools for remote working/ communications/project management; webinar participation; thought leadership (white papers, blogs); digital marketing & business development support; CPD (continuous professional development); and mentoring/coaching. Around one-third of respondents said their role had changed to accommodate new responsibilities, often as a result of colleagues being made redundant, furloughed or placed on temporary leave.

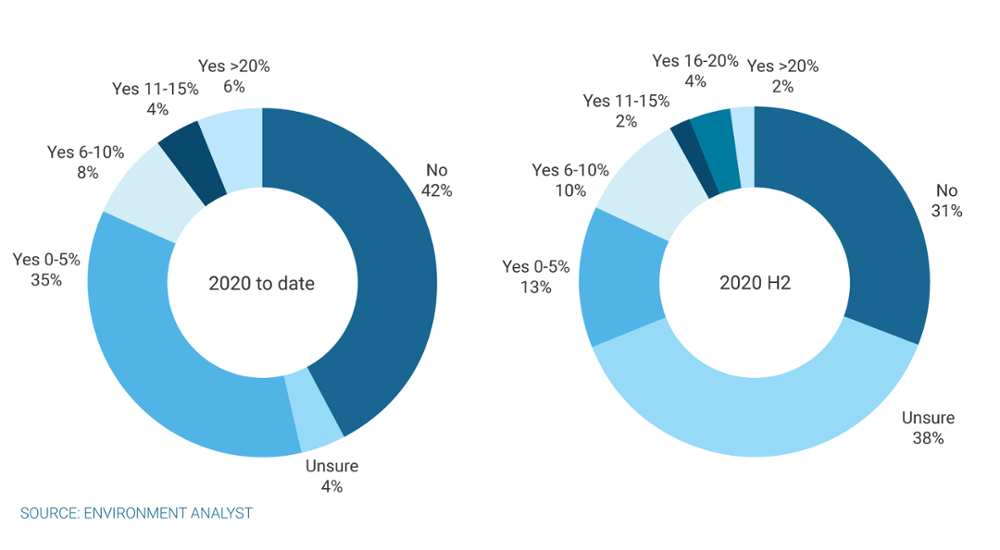

- Job losses during the first six months of 2020 were indicated by 53% of all survey participants, most commonly impacting up to 5% of the total team or workforce. Going forward, 31% said they do not anticipate any further layoffs during the second half of the year, while 31% do expect more to come. However, there is a good deal of uncertainty around that with another 38% of the sample unsure whether there will be more redundancies impacting their organisation this year.

Fig 1: Job loss trends (Global CV-19 Industry Impacts & Outlook Survey, June 2020)

- Other cost-cutting measures - the most common of these impacting survey participants, indicated by 58% of the global sample, was reduced budgets for attending events/continuous professional development (CPD), closely followed by reduced weekly working hours (54%). Around one-third (34%) said their remuneration (salary plus bonus) package had been frozen, while slightly more (38%) had their package cut - leaving 28% of participants unaffected (as yet) on the pay front. Enforced paid time off (PTO) or sabbaticals (unpaid leave) were cited by 30%.

- Mixed experience of government coronavirus financial support initiatives - with 37% saying they had been effective for their organisation, versus 41% who said they were ineffective or nonexistent.

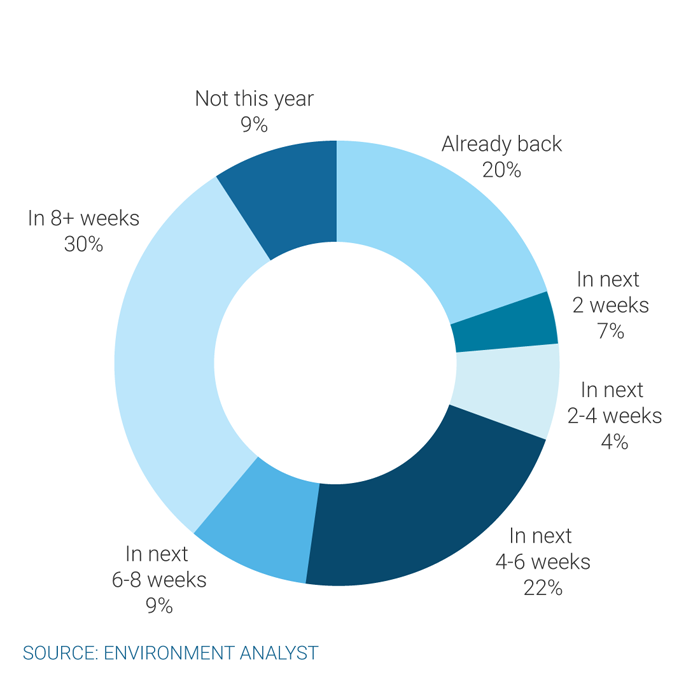

- WFH and office reopening trends - our survey suggested that one-fifth of respondents had already returned to the office by mid-June with another 42% due back in the next eight weeks. Meanwhile, an additional 30% felt it would be longer than eight weeks, with 9% not envisaging returning to the office at all this year. Almost half the respondents said they had concerns about returning. On average people worked one day per week from home prior to lockdown, rising to five days during lockdown - with an expectation that it would be reduced to an average of three days per week as restrictions ease during the second half of the year. Most expect WFH days to stay at that level through 2021 as socially distanced work spaces continue to be the norm.

Fig 2: When do you expect to return to the office (Global CV-19 Industry Impacts & Outlook Survey, June 2020)

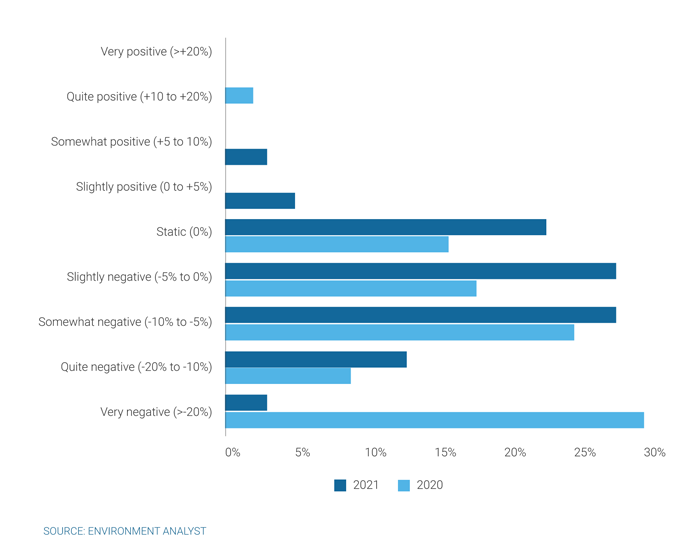

- Financial impacts and outlook for 2020 & 2021 - as the chart below indicates the vast majority of survey participants expect a static or negative impact on their organisation’s revenues, both this year and next. The mean average change compared to the prior year is -9.3% in 2020 and -4.8% in 2021. For small firms (<100 FTEs) the expectation was a little worse at -11.3% and -5.6% respectively, while for large firms (>1,000 FTEs) the mean expected growth rates were a little better (2020: -7.9%; 2021: -4.6%). For most organisations, contractions of this order would mean profits are completely wiped out this year, given that the environmental consulting sector’s average operating margin is around 10-11%. However, this industry is still showing greater resilience than other related sectors; the global management consulting market for example is expected to fall back by 18% during 2020 (EA 19-May-20). When looking at the regional trends, our survey respondents based in Asia Pacific predicted a milder impact than those in EMEA and the Americas, with APAC growth rates averaging -3.3% in 2020 and -2.9% in 2021.

Fig 3: Revenue impact compared to previous year (Global CV-19 Industry Impacts & Outlook Survey, June 2020)

To end on a positive note following the stark financial predictions, our readers do believe that the global pandemic will ultimately effect positive changes in the transition to a net zero, sustainable economy - with 57% saying so. The median respondent expects the COVID crisis to accelerate the low-carbon transition by up to three years, with one-third believing it could be by more than that.

---

All survey participants and EA Strategic Members will be receiving an email giving access to the full set of our COVID-19 Industry Impacts & Outlook Survey charts and analysis. If you are not a member but interested in obtaining a copy please contact Lisa Turner (lisa@environment-analyst.com)