Peter Hall will be a key participant in the panel discussion on nature-driven design and solutions at Environment Analyst’s Global Business Summit (23-24 August, Denver). Here he offers a preview of his insights.

EA: Can you describe the physical characteristics that might define an optimum NbS? Are there a real-world examples yet?

PH: Nature-based solutions (NbS) that deliver across a range of stakeholders and can provide solutions for decarbonisation, adaptation to climate and delivery outcomes for communities are becoming the new normal. At Wood Environment & Infrastructure (E&I) we are delivering climate resilience and ESG outcomes for our clients across five important and interconnected drivers: climate change and resilience, net-zero transitions, responsible consumption, social equity and, importantly, nature, which includes NbS projects. Nature-positive projects are also a critical part of the solutions and strategy for the race to zero and resilience, and for realising resilience breakthroughs that we must collectively reach. According to the UN Environment Programme, nature-based solutions are locally appropriate actions that address challenges such as climate change and provide human well-being and biodiversity benefits by protecting, sustainably managing and restoring ecosystems, and are an essential component of the overall global effort to achieve the goals of the Paris Agreement on climate change. They represent an important area [of service] that Wood E&I provides to our clients.

An example from our wide range of projects is the McCoy’s Creek watershed in Jacksonville, Florida. It highlights many NbS attributes that we must collectively achieve to drive resilience, including building to future climate shocks, providing improvements to extreme heat, creating opportunities for communities and leveraging partnerships – for this project working with Scape Studio.

Within the economically vulnerable McCoy’s Creek watershed, dozens of roads, homes and businesses flood during regular rainfall events. The creek was channelised and bulkheaded years ago, which allowed development in flood-prone areas and destroyed the nearby floodplain and wetlands along with critical habitat for plants, fish and wildlife. The City of Jacksonville has committed $105.4m to remedy McCoy’s Creek flooding, create neighbourhood-friendly spaces, improve recreational opportunities, and protect the environment.

While keeping citizens safe from flooded roads and polluted flood waters is the highest priority, the city’s plan also includes returning McCoy’s Creek to the beautiful neighbourhood amenity it once was – so that it creates community benefits, can reduce extreme heat impacts and absorb flooding. It is a great example of some of the work we are doing to leverage NbS projects to create infrastructure that can really accelerate climate resilience and is of course scalable to other regions and countries.

EA: How is the decision to use a NbS approach reached, and by who – and, typically, how is available finance identified and secured?

PH: Often the decision to apply a NbS approach comes from entities such as cities (and their capital improvement plan – CIP – budgets along with grants) that require projects that can address a range of stakeholder needs and can provide multiple benefits. On a regional or national scale, NbS projects are also being funded by governmental agencies or global environmental nonprofits such as the Inter-American Development Bank or The Nature Conservancy. Often these projects are financed through public-private partnerships (P3s) which then puts a priority on delivery across a range of interests and agencies in the planning, delivery and operation of assets – with people being at the centre of what we develop. The days of having a project conceived, designed and delivered in a siloed approach are behind us (or should be). Increasingly NbS is being driven by cooperative development banks and other green finance mechanisms such the Taskforce on Nature-related Financial Disclosures (TNFD).

TNFD seeks to drive a shift in global financial flows away from nature-negative outcomes and towards nature-positive outcomes. While TNFD taskforce members represent institutions with over $19.4tn in assets under management and a footprint in over 180 countries, a pipeline of NbS projects has to be accelerated to connect financing to delivery for impact.

Often the decision to use a NbS approach can be accelerated by asking the right questions to impacted stakeholders and then acting on those inputs and including them in the project design and delivery. Key areas include:

- Framing the issue (why)

- The challenge (of what, to what, for whom)

- Mainstreaming resiliency (how)

- Partners and scale (accelerate and measurement)

EA: To what extent does the availability of finance determine the type of project that is amenable to an NbS approach? Is this a limitation?

PH: There is increasingly a compelling case being made by asset owners and financing to leveraging NbS in tandem with or in-place of traditional infrastructure. A limiting factor, as often the case with infrastructure in general, is the disconnect between design, delivery, operation and integration across the full project lifecycle. People must be at the centre of NbS, and we must also look at projects with the correct timescale. We are supporting the Meridiam/Rockefeller Foundation/PIDG Urban Resilience Fund (TURF), which represents a new connection of resilient infrastructure to private finance. By looking at projects that must last for 20-30 years and provide co-benefits to the people impacted by the projects our hope is that more funds such as this can be developed to increase financing and connect bankable projects to the money that exists in the market.

Regarding financing it is becoming increasingly important to engage across the range of the finance market spectrum including investors/stakeholders, asset owners, investment & fund managers, financial markets, corporations and of course workers and consumers. Having the range of finance stakeholders coalesce under a common mission or project output can be a helpful integration driver.

EA: Is there a disconnect between the timescales required by financial returns and those required to meet resilience, adaptation and biodiversity goals?

PH: At Wood E&I we are creating projects that are more "bankable" by looking at not just what a project "is" but what it "does", meaning the services they provide and the lifespan that infrastructure projects must function for. Increasingly NbS play a key role in helping projects reliably function in the face of climate shocks, for example how nature can absorb floods, provide heat protection or improve air quality. It is critical that our project owners/clients look at delivery as a long-term commitment. Often the co-benefits a NbS project delivers is realised over a long (20+ years) time period. I think the acceleration of TNFD and work that we support with the UNFCCC Climate Champions team can really advance and scale NbS in both the global North and South. I also think ESG funding and outputs can start connecting to NbS projects and outcomes. Some of the funding trends that we see driving the work and delivering the needed NbS projects will certainly come from this, e.g.:

- $15tn+ infrastructure gap to meet by 2030

- Investors, shareholders, employees, and society expects $90tn in funding by 2030

- 42% of companies with a $10bn+ market cap aligned with TCFD and over 60% of the world’s 100 largest public companies support its aims

- The $2.2tn ESG debt market could swell to $11tn by 2025

- Nature-positive transitions could generate up to $10tn in annual value and create 395 million jobs by 2030 aligning with TNFD.

Some of options to align financing to NbS projects and to catalyse investment include applying frameworks to measure, understand and integrate resiliency into projects and programmes, to drive adaptation to climate shocks, to create community benefits and provide resilience for people and the infrastructure they rely on. At Wood E&I we have developed the ‘ADAPT’ framework, which provides our organisation with a consistent system across the business that can be applied to any infrastructure project to ensure projects are built to last, can create co-benefits and create transformative outputs for the people that rely on those assets.

Accelerating funding for critical infrastructure to drive the resilience dividend and ESG performance with our ‘ResilienceLens’ platform also plays a key role in accelerating investments.

Developing a roadmap to integrate and measure the resiliency dividend is key part of the structured and dynamic process that is needed to set relevant targets, map assets, and identify the right solutions to protect, adapt and transform, especially through NbS projects. When done well these projects can:

- Maximise investment opportunity, access capital

- Create ‘bankable projects’ pre-feasibility

- Serve as a critical link between infrastructure and finance

- Demonstrate the resilience dividend

- Prioritise projects and drive key resiliency features

- Enable delivery of a just and resilient recovery

- Prioritise projects to identify high resilience value (ESG/TCDF)

EA: Where do you see the greatest opportunities for expanding and scaling up the deployment of NbS into the future?

PH: Some of the opportunities we are seeing for NbS and projects, which we expect to only increase, come from when key sectors transform and collaborate for actions – including a closer alignment with the financing sector. The water, agriculture and industrial sectors all play a significant role in this work. The work that the UN climate champions are driving around resilience breakthroughs should play a vital role in accelerating actions, providing connections to finance and driving outcomes – especially in developing countries. Projects that have been successfully delivered in cities can be scaled to other areas. Some of our work is with partnerships such as the Resilient Cities Network. NbS projects that work in one city can often be efficiently scaled to other cities.

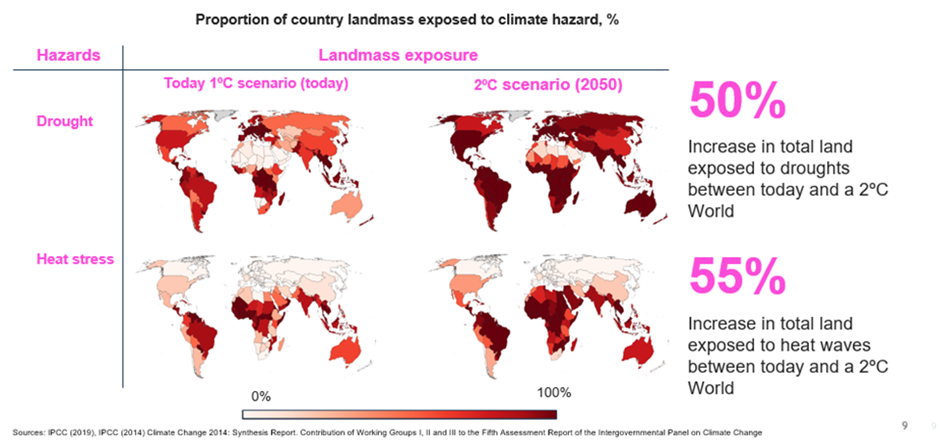

Another opportunity that we are seeing is in support of NbS alignment with the needs of coastal, urban and rural communities, especially with extreme heat and land exposure to climate hazards projected to increase by over 50% by 2050 in a 2ºC scenario.

Our work at Wood is to plan, design and deliver the projects that access the available capital and create positive impacts for people. NbS projects and programmes are critical for addressing the challenges we must solve.