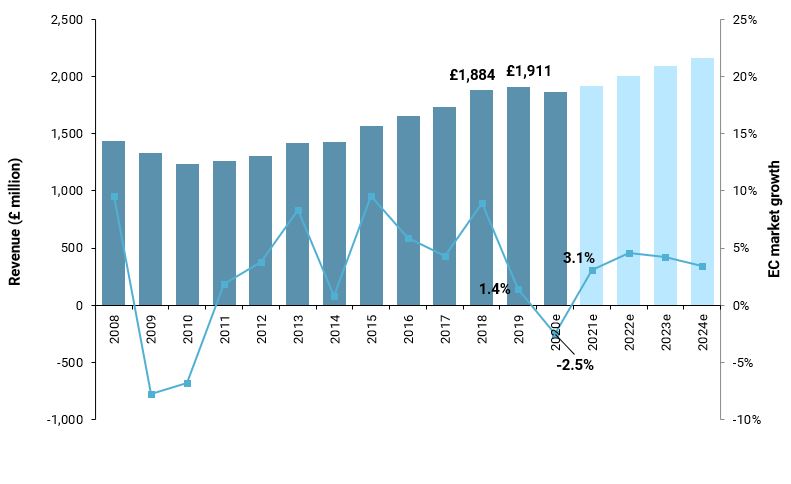

The UK market for environmental sustainability consulting (EC) services looks set to decline by 2.5% in 2020, according to the latest market research published by Environment Analyst. The performance is commendable given the UK economy suffered the worst economic slump (-9.9%) since 1709 - highlighting the resilience and adaptability of consultancies in difficult circumstances.

Our latest market assessment report finds growth was already slowing due to the uncertainty created by Brexit prior to the outbreak of CV-19. UK EC market growth slowed by 7.5 percentage points to just 1.4% in 2019, a slowdown not seen since the commodity supercycle downturn in 2014 (see figure 1). Despite this, the sector returned a record market value of £1.91bn.

The UK EC market is expected to rebound to 3.1% in 2021 driven by continued infrastructure investment, government green stimulus spending, and a surge in demand for services to tackle the climate and biodiversity crises and support on ESG momentum. The five-year forecast compound annual growth rate (CAGR) of 2.5% between 2019 and 2024 has been tempered to reflect the ongoing challenges presented by CV-19.

"The resilience of the environmental & sustainability consulting sector over the last two years in weathering both Brexit uncertainty, and the challenges presented by the CV-19 pandemic has been nothing short of extraordinary," said Ross Griffiths, content director at Environment Analyst.

"The plaudits must go to the 20,000 environmental consultants that make up this sector and who worked, and continue to work, with great uncertainty and in difficult circumstances at home and onsite delivering key environmental services for clients and stakeholders up and down the country."

"As we move through this decade of action, the organisations within this sector are uniquely positioned to help design and deliver the inclusive and sustainable economy that this country needs."

STRATEGIC MEMBERS CAN DOWNLOAD THE REPORT HERE

Figure 1: UK EC market and revenue growth 2008-2024e

The fully updated edition of Environment Analyst’s Market Assessment of the UK Environmental Consulting Sector 2020/21 (report) is based on reported financial statistics (FY2019/20), robust company forecasts for FY2020/21 and detailed company profiles of the leading peer group of 30 EC practices based in the UK, as well as Environment Analyst’s wider annual company survey results.

Headline findings:

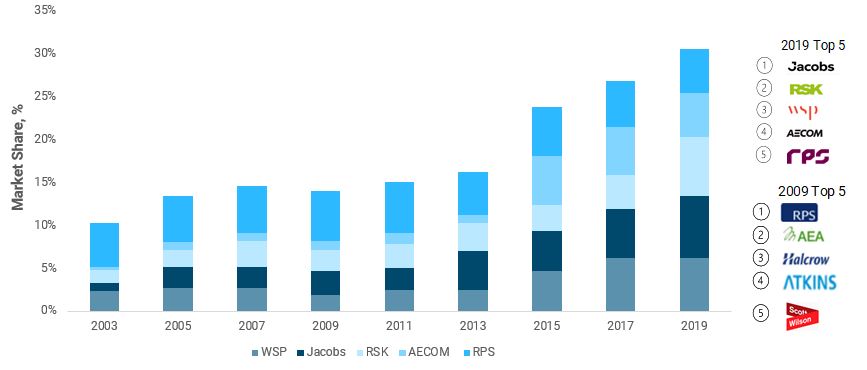

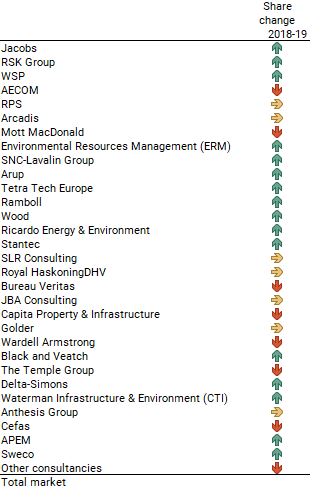

The UK EC market has a new market leader as Jacobs emerged with a market share of 7.2% ahead of RSK, WSP, AECOM and RPS. These five firms now account for over 31% of the market, up from 28.5% in 2018. This marks a dramatic shift from ten years ago when these same five practices accounted for just 14% of the UK EC market, showing the scale of market consolidation that has occurred (Figure 2). Arcadis, Mott MacDonald, ERM, SNC-Lavalin and Arup complete the top ten.

Fig 2: Market share change of the Top 5 EC firms in 2019, since 2003

Today the UK Top 30 has a distinctly international feel with just under half (14) of the UK’s leading environmental consultancies now owned by businesses headquartered overseas [of which eight are North American]. Despite this international influence, environmental consultants based in the UK now earn less revenue from international projects (10.5% of UK EC revenue) than they did in 2018 (12.8%). This may shrink further into 2020 & 2021 given current CV-19 restrictions on travel.

M&A deal activity continued apace in 2019 with the Top 30 UK EC practices recording acquisitive growth of 4.9% - its highest since 2010, but organic growth of just 0.9% - its worst performance since 2014. Between 2019 and 2020 acquisitions involving environmental consultancy practices halved from 20 to just nine. Of those nine, Ares Capital-backed RSK accounted for six.

The start of this year has seen five purchases shake up the UK EC sector including: WSP’s purchase of the 7,000 strong global earth sciences and environmental specialist Golder for US$1.14bn (EA 08-Dec-20); RSK’s acquisition of Black & Veatch’s 1,200-strong UK and Asia water business [now rebranded Binnies] (EA 18-Dec-20); Jacobs’ investment in a 65% stake in the London-headquartered 3,200-strong management consultancy PA Consulting (EA 01-Dec-20); the sale of a minority share in Anthesis’ business to Manchester-based Palatine Private Equity (EA 09-Mar-21), and Lucion Services’ (which also backed by Palatine PE) purchase of Delta Simons (EA 07-Apr-21).

Five companies achieved substantial growth (>20%) in their EC revenue during the period – Tetra Tech Europe (including WYG), RSK, Jacobs, Delta-Simons and Waterman – while a further five saw in the region of 10-20%. Seven of the Top 30 saw revenue decline in the latest year analysed, although reassuringly there was no unifying reason for their respective struggles.

Over the last three years the Top 30 UK EC firms have either recruited, or integrated into their teams (following acquisitions), an additional 2,900 environmental consultants. During 2019 the number of environmental consultants employed by the Top 30 grew by 6.2% to 14,300 FTE. Note this is far higher than the recruitment trends for the wider group businesses (in the case of those with large multidisciplinary parents) where group staff numbers increased by just 1.4% to 76,000.

The average revenue per head generated by a UK environmental consultant is £98.5k, marginally down on 2018 suggesting the industry is struggling to raise utilisation, billability and/or fee rates. This is far lower than the global EC revenue per head for 2019 of US$183k (c£130k).

Fig 3: Top 30 UK EC players in 2019/20

Segmental breakdowns

The report breaks down the UK EC Market into twelve distinct ‘service areas’ and six client verticals providing annual and forecast segment revenues and growth, as well as listing the Top 20 environmental consultancies operating in each segment.

Four core service areas make up almost three-fifths of the UK EC sector by revenue in the latest year assessed. They are impact assessment, water quality & resource management, ecological/wildlife services and contaminated site assessment/remediation. Interestingly three of these four experienced a decline in demand with only impact assessment showing growth.

The climate change and energy service area – which includes climate mitigation, climate adaptation, energy management and renewable energy advisory services – finally hit the kind of growth we have been expecting as the net zero movement gathered pace. The service area grew by 17.1% in 2019, and then by a further 5.0% in 2020, despite the CV-19 pandemic. The period 2018-20 has been notable in terms of the momentum generated to address the climate crisis. Extinction Rebellion, the rise of youth movements spurred by Greta Thunberg, and the widespread concern over the acceleration of global warming have seen both the public and private sector ramp up net zero ambitions, buoyed by the increasing involvement from the financial sector.

Elsewhere, demand for ecological / wildlife services dipped for the first time since Environment Analyst began compiling market data with revenue down 0.4% in 2019 to £250m. While only a minor decline, it does suggest this service area – which has been a stellar exemplar of long-term success – may be reaching maturity. Revenue is expected to decline by a further 4.0% in 2020 as CV-19 impacted project timelines and site access.

In terms of client verticals - infrastructure & development (transport & property) clients spent an additional £50m on environmental consultancies in 2019, up 8.9% year-on-year. This confirms the I&D sector remains the industry’s leading source of income accounting for a third of sector revenue. However, given the impact of the protracted lockdowns in 2020 and the inevitable impact on project timelines we anticipate spending will fall in 2020.

The extractive, manufacturing and processing client sector – which includes the heavy industry areas of manufacturing, mining, quarrying & metals and also chemical & pharmaceutical operations – underwent its largest year-on-year decline in a decade with spending down 21.1% to £160m.

To read the full 108 page Market Assessment of the UK Environmental Consulting Sector, and the UK Competitor Analysis report, you will need to become a Strategic Member of Environment Analyst. For more information please email lisa.turner@environment-analyst.com.