In this chapter of Environment Analyst's Corporate Guide: Accelerating your ESG transition, Ramboll's global director of ESG services, Alan Kao, details how to make meaningful progress in ESG impact, and embed your ESG strategy within your company’s purpose and business operations.

Introduction: a roadmap towards sustainability and social responsibility

While many organisations have incorporated ESG practices into their operations, it is essential to emphasise the significance of meaningful progress.

Meaningful progress goes beyond mere compliance or token gestures and requires a deep commitment to sustainable practices and social responsibility. It involves distinguishing between risk and opportunity, setting ambitious goals, implementing tangible actions, and continuously improving performance across all material ESG dimensions.

This chapter explores the key elements and strategies that can help organisations drive meaningful progress in ESG impact.

The risk-value-impact spectrum

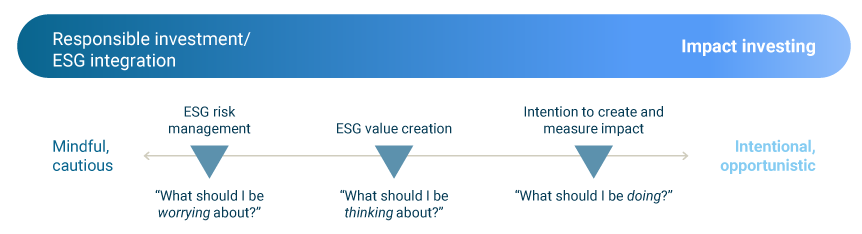

Companies have adopted a range of different approaches to how they integrate ESG considerations into their operations (see figure).

Some companies take a cautionary approach to ESG. They view ESG as a risk management tool, and want to use it to ensure there are no ESG issues that could affect their reputation in a negative way. Their goals are to avoid unintended consequences and not back into risk unwittingly. They’ll talk about ESG from the view of "do no harm" or "do less harm". It’s about being mindful, and asking "what should I be worrying about"?

At the other end of this spectrum are companies that are seeking to have some sort of environmental or social impact with their products and services. ESG topics are a key part of how they present their company’s vision and mission, or differentiate themselves in a crowded market. They’ll talk about ESG from the view of "do more good", and ask themselves "what should I be doing"?

The risk-value-impact spectrum for ESG (source: Ramboll)

Finally, there are companies that are somewhere in the middle of this spectrum. They certainly want to ensure there are no unmanageable ESG risks associated with the company, but they are also viewing ESG as an opportunity to create value, increase sales, open new market opportunities, improve employee attraction and retention, and become a valued member of the community. They are starting to be more intentional in their thinking, and asking "what should I

be thinking about"?

Companies that are struggling to understand why they don’t seem to be making any meaningful progress in ESG impact should consider how they view ESG with respect to risks and opportunities. Are they thinking about it primarily from a risk mitigation standpoint, with all policies, programmes and initiatives focused on ensuring compliance with regulatory requirements? Or are they thinking about ESG from a value creation standpoint, and seeking opportunities to achieve an environmental or social impact with their products and services? For which topics can they accomplish both? Once that distinction is understood, the company will be in a better position to allocate the appropriate resources needed to achieve meaningful progress relative to their goals.

Avoiding the ‘everything is material’ mentality

The final battle scene in the film Avengers: Endgame is a spectacular achievement. The movie’s directors manage to include more than 30 main characters from every corner of the Marvel Universe, along with a few groups of nameless characters, into a single scene, resulting in a cinematic feat that will be difficult for any movie studio to replicate. However, this ambitious desire to incorporate everyone into the 30-minute scene resulted in some characters not getting the screen time they deserved, and the inclusion of other characters felt forced and did not contribute to the storyline in a meaningful way. This is comparable to the challenge that companies face as they consider the scores of environmental, social, and governance topics that apply to their business to varying degrees and attempt to demonstrate progress in as many of them as possible.

In 2020, we were entering the ‘decade of action’ with respect to meeting the Sustainable Development Goals (SDGs) by 2030. The United Nations had declared that we had ten years to transform the world and deliver the global goals. Many companies responded by publishing glossy brochures or colourful infographics on their websites where they showed how they were contributing to meeting all 17 of the SDGs. They were looking to ‘check the box’ on all 17 goals, which misses the point of the goals because it gives the impression that by conducting business-as-usual, they were helping to achieve goals that will require collective future actions from companies and governments.

A better way to achieve meaningful progress on the SDGs – or any sustainability agenda – and one that is looked upon more favourably by investors, is to focus on a handful of goals that are material to your company’s business strategy and mission. This avoids having restaurant chains struggle to find examples of how they are contributing to protecting Life Below Water (SDG 14) and allows them to focus instead on steps they can take to address the Zero Hunger (SDG 2) and Gender Equality (SDG 5) goals. It also prevents companies from allocating limited resources and capital to improve performance in an area that will not contribute to the success of the business in a meaningful way.

Similarly, the first step of developing an ESG strategy for acompany is typically performing a materiality assessment to identify the most significant ESG issues relevant to the organisation and its stakeholders. This process involves mapping ESG factors against business operations and stakeholder concerns to identify the issues with the greatest impact and influence. By focusing on material issues, organisations can prioritise their efforts and allocate resources effectively.

However, upon reviewing a long list of potentially material ESG topics, internal stakeholders often say that "all of these are important". Furthermore, they fail to distinguish between risks and opportunities within those topics. The result is a laundry list of ESG topics with no distinction between risk-reduction measures and strategic opportunities, and limited inclusion of business context, which is difficult to use as a foundation for building an effective ESG strategy.

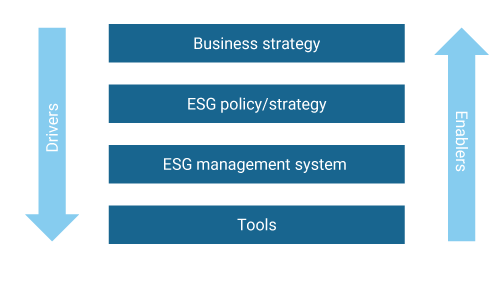

Relationship between ESG strategy and business strategy (source: Ramboll)

Setting targets is one thing, achieving them is another

Once a baseline assessment has been completed and a company is aware of their current state with respect to managing material ESG topics, the next step is to set meaningful targets that will achieve the desired impact. However, targets that are vague or uninspiring or not clearly connected with the company’s business strategy are unlikely to result in success. By considering the following targetsetting principles, you will improve the likelihood of achieving the goals:

(i) Clarity

To get the best results, the targets a company sets must be clear and specific, so people will know when they have been achieved. This is where people are often encouraged to set SMART (specific, measurable, attainable, relevant, and time-bound) goals.

(ii) Challenge

Targets should represent challenging goals. Those that are too low or viewed as business-as-usual are unlikely to be inspiring or to impress customers, investors or other stakeholders. However, it is important to avoid setting goals that are so challenging that they can’t be achieved (e.g. net zero by the end of the year) and will be so daunting that teams are reluctant to take any action at all.

(iii) Commitment

Team members are more likely to ‘buy into’ a target if they have been involved in the process of setting it. This can be through participating in the materiality assessment, a target setting workshop, or some other consultation process. Their willingness to help achieve the target will hinge on whether they believe the goal is achievable, it is consistent with the company’s ambitions, and the person assigning it is credible.

(iv) Comment

A mechanism should be in place to provide feedback as work towards a target progresses. This allows for clarification of the goal or course correction where necessary.

(v) Complexity

The time allotted to achieve a target must take into account the complexity of the task. Some targets are dependent on technologies that have not yet been developed or become widely accepted or available. Others may involve a significant amount of research and development, particularly if it involved re-engineering a particular product, component, or packaging.

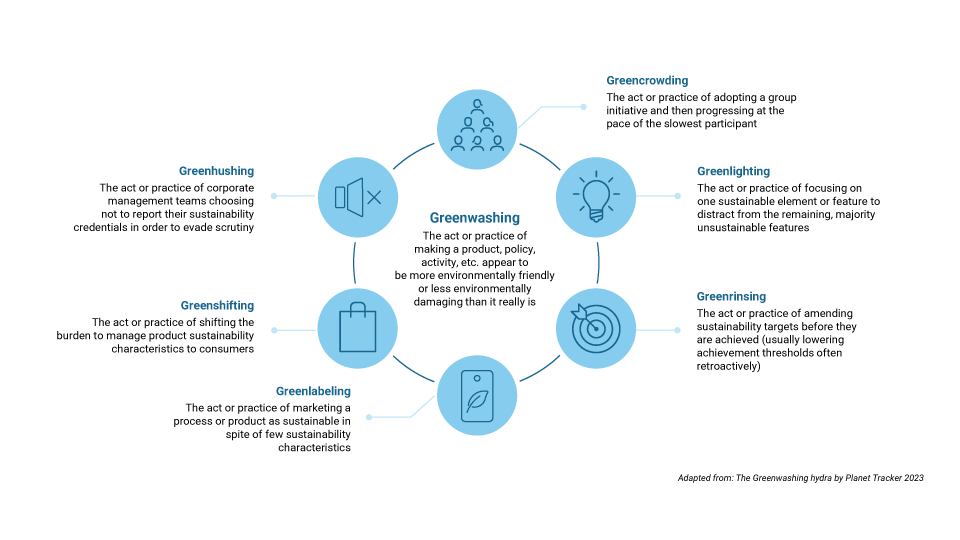

The various shades of greenwashing (source: Ramboll)

Key elements for a roadmap to make meaningful progress in ESG impact

To truly move towards meaningful progress in ESG impact, businesses must go beyond surface-level measures and embrace a comprehensive approach that integrates sustainability and social responsibility into their core strategies. A roadmap for accomplishing this must include the following elements:

(i) Integration into business strategy: A company’s ESG journey should begin by embedding sustainability and social responsibility into the organisation’s core business strategy (see figure). This involves aligning ESG objectives with overall business goals and incorporating them into decision making processes at all levels and across the organisation. The business strategy drives the priorities of the ESG strategy and the underlying management system and tools needed to implement the strategy, thereby allowing the ESG strategy to enable the company to achieve its business goals. By integrating ESG considerations into strategic planning, organisations can ensure that sustainability becomes a fundamental driver of long-term success.

(ii) Transparent reporting and disclosure: Transparent reporting and disclosure are crucial for meaningful progress in ESG impact. Organisations should strive to provide accurate, relevant and comprehensive information on their ESG performance. This includes disclosing ESG metrics, targets and progress in a standardised and easily understandable manner. Transparent reporting enhances accountability, builds trust with stakeholders, and facilitates informed decision-making. However, it is important that claims being made by companies are authentic, supported by data and avoid greenwashing, which is increasingly becoming more prevalent (see figure).

(iii) Stakeholder engagement: Engaging with stakeholders, including employees, customers, investors, and local communities, is essential for driving meaningful progress in ESG impact. Organisations should actively seek input, listen to feedback, and incorporate stakeholder perspectives into their ESG strategies. This inclusive approach fosters collaboration, engenders further buy-in and solidarity, generates innovative ideas, and ensures that ESG initiatives address the needs and expectations of diverse stakeholders.

(iv) Continuous improvement and innovation: Meaningful progress in ESG impact requires a commitment to continuous improvement and innovation. Organisations should regularly review their ESG performance, set ambitious targets, and implement measures to drive positive change. This includes investing in research and development, adopting new technologies, and exploring sustainable business models. By embracing innovation, organisations can lead the way

in creating sustainable solutions and driving industry-wide change.

(v) Collaboration and partnerships: Collaboration and partnerships are key to achieving meaningful progress in ESG impact. Organisations should actively seek collaborations with industry peers, non-governmental organisations, governments, and other stakeholders to collectively address complex sustainability challenges collectively. By sharing best practices, knowledge, and resources, organisations can amplify their impact and contribute to broader systemic change.

Conclusion

Moving towards meaningful progress in ESG impact requires a holistic and integrated approach that goes beyond surface level measures.

By embedding sustainability and social responsibility into business strategies, promoting transparency and accountability, engaging stakeholders, pursuing continuous improvement and innovation, and fostering collaboration and partnerships, organisations can drive positive change and create a lasting impact on the environment and society while also achieving their business objectives.

This requires focus on a subset of ESG topics that are most material to a company and its mission, as well as careful planning as targets are set that will be reported against.

—

This chapter of Environment Analyst's Corporate Guide: Accelerating your ESG transition was kindly authored by Alan Kao, global director, ESG services, Ramboll (www.ramboll.com)