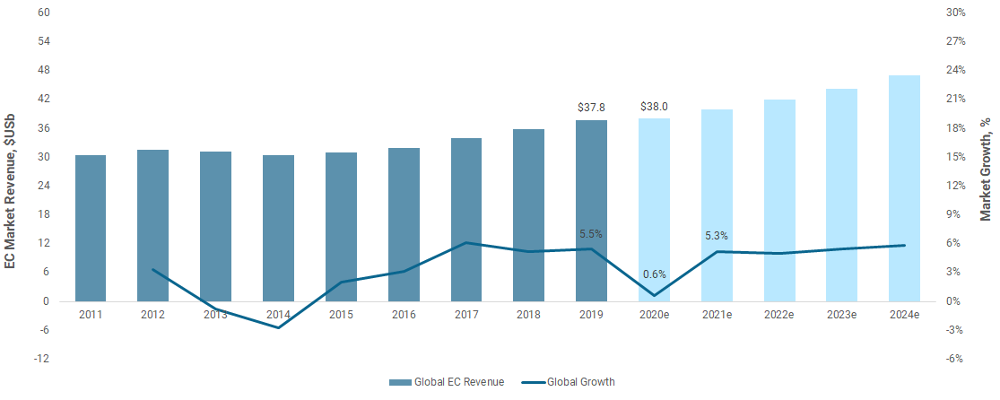

The global market for environmental sustainability consulting services grew by just 0.6% last year to total $38.0bn, following healthy increases of 5-6.5% per annum recorded from 2017 to 2019, according to EA's latest Global Environmental Consulting Strategies & Market Assessment report.

This is a resilient performance given the unexpected and unprecedented challenges thrown up by the health crisis disruption and market reverberations, which saw global economic growth dip to -3.3% - making the CV-19 recession the deepest seen since the second world war. The natural resources downturn through 2013 and 2014 caused more severe scars to the sector than COVID in 2020 as Figure 1 indicates.

"It is to the credit of the 200,000-plus strong workforce of environmental practitioners and business leaders that make up this industry who continued to work in uncertain and extremely difficult circumstances, both at home and onsite, delivering key environmental services for their clients across industry and government worldwide," commented Liz Trew, Environment Analyst cofounder & director.

"For many firms the COVID-constrained operating environment has really accelerated many of the fundamental changes that were already underway in the sector, not least around the ‘future of consultancy’ - in terms of workforce flexibility, employee wellbeing and the digital toolbox to serve and stay connected with clients and stakeholders.

"But perhaps more importantly than anything the pandemic has fuelled a business and society-wide awakening to the fragility of the planet and its ecosystems and their interconnectedness with human populations, as well as the inherent financial risk of shocks like the climate and biodiversity crises, galvanizing the movement towards ESG-driven and SDG-friendly government policies and business strategies."

Trew added: "Environmental consultancies are now in a strong position to support, enable and lead clients and stakeholders in designing and delivering a clean, equitable and sustainable transition to greening the global economy and infrastructure." The report points to a rebound in market growth to 5.3% in 2021, with an expectation of approximately $9bn in new market space being opened up in the next four years.

Fig 1: Global environmental sustainability consulting market revenues and growth, 2011-2024(e)

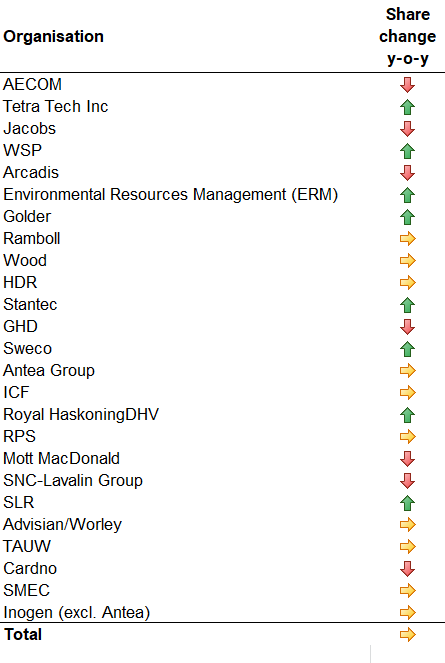

Market leaders

Environment Analyst bases its market estimates primarily on the performance and dynamics of 25 leading international environmental consulting players (the ‘Global 25’), whose EC businesses are profiled in depth in our report series. These firms - which are active in at least two or more global regions - have annual EC revenues ranging from $75m to $2.64bn and together command a 44% share of the market with their overall rankings shown in Figure 2. The Global 25 are collectively responsible for servicing some 279,000 EC contracts per year, through a specialist staff contingent numbering 90,500 (FTE). These companies have grown their aggregated EC revenues by over 66% during the last decade driven by globalisation and M&A activity which has allowed the top ten firms in particular to outperform the market as a whole and act as industry consolidators.

AECOM remains the longstanding market leader with a global EC team of around 7,700 environmental consultants and a market share of 7.0%, having grown this part of the business by 6.7% in 2019 thanks primarily to a strong performance in its North American business. Amidst the challenges of COVID during 2020, AECOM’s environment practice rolled out a digital NEPA platform to enable safe and streamlined presentation of environmental permitting materials, whilst it was able to utilise digital audits and due diligence tools to help keep its environmental management projects on track despite travel restrictions. This is really indicative of the wider sector’s success in overcoming the short-term obstacles presented by CV-19 through the introduction of new and improved solutions for clients.

But the US-headquartered firm’s position at the head of the EC providers table is coming under increasing pressure from several key challengers. Notably, the current number four WSP has been rapidly ascending the ranks over the last few years in pursuit of achieving its goal of becoming the sector premier; and in 2019 the firm added some 1,600 additional FTEs to its environment practice through both organic growth and acquisitions (notably including Louis Berger), with its EC revenue total up by more than 80% year-on-year. WSP’s position will be further boosted in the next edition of EA’s rankings when its latest crop of acquisitions - including the seventh-ranked global EC player Golder - are added to its total, despite having an essentially flat year organically in 2020 given the pandemic headwinds.

Other firms in the Global 25 who managed to grow their market shares in the latest fiscal year (FY19/20) analysed in the report were: Tetra Tech, ERM, Golder, Stantec, Sweco, Royal HasonkingDHV and SLR (Figure 2).

Fig 2: Global environmental consulting market rankings by revenue, 2019/20 (the ‘Global 25’)

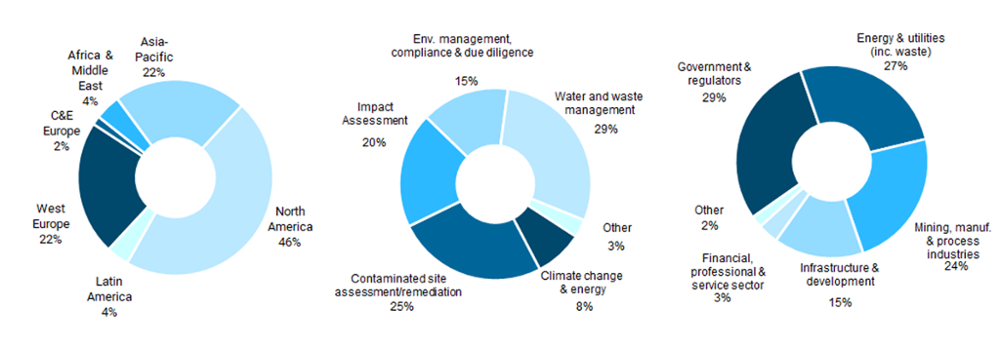

Trends by region, service area and client sector

The fully updated and expanded edition of our annual global market report (and the accompanying Competitor Analysis) includes company insights, rankings and growth trend variance by global region, service area and client sector. Market revenues in Western European were more severely impacted by the CV-19 restrictions and lockdowns with growth at -1.5%, compared to +0.5% in North America in 2020, following healthy organic increases of 5.5% and 5.0% respectively in 2019. The market breakdown by region is shown below (Figure 3), with demand for services in the Asia-Pacific and the Middle East & Africa regions showing positive growth through both 2019 and 2020. Meanwhile, the Latin America and C&E Europe regions were already sluggish or contracting prior to the CV-19 year, swinging down to a more negative position last year.

Based on a breakdown of the Global 25’s aggregate EC revenues pre-COVID, the EA report finds that climate change and energy services saw the biggest increase in 2019, at 13% year-on-year, although it accounts for a relatively small proportion of their total revenues at 7.9%. Environmental management, compliance & due diligence and water & waste management services also saw strong growth at between 7-9%. But impact assessment was down by 2.5%, which is almost certainly a reflection of the former US president Trump’s anti ‘red-tape’ stance more than any other single factor (EA 12-May-21), and contaminated site assessment/remediation saw a small uptick after struggling for some years on account of market maturity in the dominant North American region.

The Global 25’s work for government & regulators - which accounts for 29% of the revenues when split by client sector - contracted by a couple of percentage points, which again reflects reduced federal environmental budgets and softer political momentum in the US. But this is all set to change with the pro-climate Biden administration. By contrast, growth was most notable in EC work for energy and utility companies, a sector where the market leaders saw a double-digit surge in 2019. The heavy industry sector (including mining, manufacturing and process firms) disappointed with growth at -1.9%, as did infrastructure & development at -6.6% after an extended run of strong annual increases with a double-digit CAGR from 2014 to 2019. The smallest of the five main industry sectors segmented - financial, professional & services - saw a moderate increase of 3.7%.

Fig 3: Global environmental consulting market by region, service area and client sector 2019/20

Scale vs specialism?

The full 176-page report provides a decade of historic revenue figures, as well as modelled projections for all the regions, service areas and clients sectors for 2020 to 2024. The unparalleled industry data and insights presented in this report also consider the variance in performance and global strategies according to the different business models active in the environmental sustainability consulting space. New Global 25 entrants TAUW and SMEC were included in the analysis for the first time in this edition, with the report also providing a list of the Top 100 global providers according to our proprietary database.

As Environment Analyst’s Liz Trew explains: "Our analysis suggests that the global EC market has broadly been in a resurging period from 2015 to 2019 - at least until COVID hit - coming out of the earlier commodity super-cycle down dip. During this time EA data shows the generally smaller-scale environmental specialist players such as Golder, ERM, SLR and TAUW outperforming the wider market, whilst the large and mid-scale integrated and multidisciplinary service providers struggled to achieve consistent organic growth.

"But much has changed in the last 24 months, particularly that most of the non-specialists have decided to strategically prioritise climate resilience, ESG and sustainability at board level and embed these principles across their businesses as a whole (which certainly wasn’t the case even five years ago).

"This is becoming an important differentiator in the environmental services space, as are the huge investments in technology-enabled solutions and innovative collaborations with management consultancies, IT giants and sustainability startups by the likes of Jacobs, Tetra Tech and Wood et al - with traditional service disciplines and siloes being broken down within the broader professional and technical services industry - as they support clients in their journeys to becoming better global citizens."

Fig 4: Market leaders by region

-----

The 176-page Global Environment Consulting Strategies & Market Assessment report and the accompanying Competitor Analysis report are available to Strategic Members of Environment Analyst, who can download both reports here. Strategic Members will have received an email with login information to access these reports.

For queries about accessing these reports please contact the sales team on email sales@environment-analyst.com or +44 (0)203 637 2191. For editorial enquiries please contact Liz Trew on liz@environment-analyst.com or (0)1743 818 2106.

-----

Hear Environment Analyst discuss our latest research findings on the environmental sustainability consultancy services market dynamics at our upcoming Global Business Summit on 8-9 June.

Summit attendees will also get to hear from the global environmental consulting market leader, with AECOM's global business line chief executive for the environment, Frank Sweet, giving the opening keynote presentation.