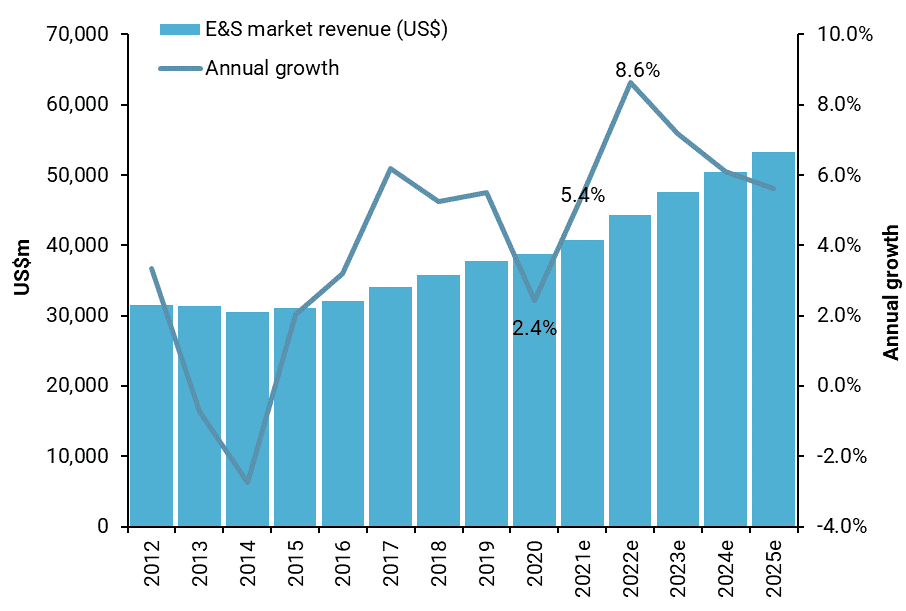

Growth in the global market for environmental & sustainability consultancy recovered to 5.5% in 2021 to reach a record value in excess of $40.8bn, according to Environment Analyst’s recently updated annual research report and data pack – Global Environmental & Sustainability (E&S) Consulting Strategies & Market Assessment. This was off the back of a more subdued 2.4% increase in 2020 at the height of pandemic impacts and lockdown restrictions.

Global strategic members can download the full 140 page report here

It is a testament to the global E&S consulting workforce, an estimated 200,000 FTE professionals, who continued to deliver projects and support their clients through extremely difficult and unprecedented times that the industry was able to weather the COVID-induced economic headwinds and put in such a resilient – and better than expected – performance during this period.

"As we continue the countdown in this ‘decade of action’ [..] the E&S consulting sector is ideally positioned to grow in scale, scope and stature" – Liz Trew, Environment Analyst

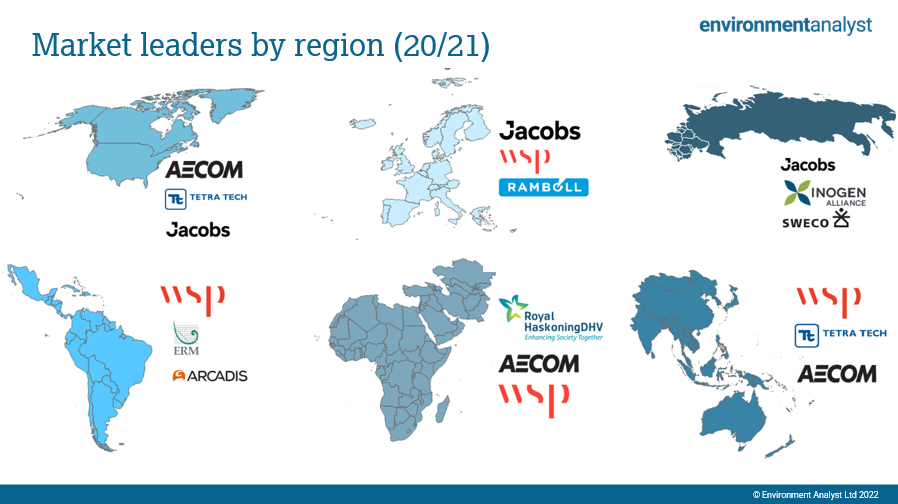

Our industry data also points to the emergence of a pack of high-flying industry leaders that are increasingly exerting their market dominance and acting as sector consolidators, including a new global number-one service provider. But at the same time, ten of the top 30 players analysed in the report saw declining E&S consulting revenues in the latest year analysed, indicating an increasingly polarised performance with pandemic pressures and industry megatrends creating a wider chasm between the market leaders and laggards.

The current "perfect storm" conditions have also spawned a bonanza in M&A deals with a peak annual total of 55 E&S-related transactions involving our ‘Global 30’ consultancies in 2021, almost double that of the prior pandemic-constrained year. A renewed spate of industry mega-mergers and the need to add specialist sustainability and digital expertise have contributed to the growing M&A volume, with the sector’s ESG credentials contributing to some eye-watering deal valuations as investors increasingly factor in an ESG value premium.

Figure 1: Global E&S consultancy market revenue and annual growth, 2011-2025e

Source: Environment Analyst based on industry data

2022 is marked for high growth

EA’s market forecast model is projecting improved underlying market growth again in 2022 of 8.6% (notwithstanding inflation*), which is higher than we have ever previously observed or forecast through the last decade. Environment Analyst finds that at least an additional $12bn of new market space will be created by 2025 as net zero plans are turned into action and many nations move towards mandating ESG & sustainability reporting, even against the declining global economic outlook. The fastest growing E&S consulting service area is climate change and energy, where revenues have been increasing by double-digits annually for the Global 30 even through the pandemic headwinds. This field encompasses services around climate resiliency and vulnerability assessments, decarbonisation and energy efficiency.

The report reveals that the top three consultancies ranked by climate change & energy consulting services revenue are: Ramboll, Arcadis and Tetra Tech.

"As we continue the countdown in this ‘decade of action’ to limit the catastrophic impacts of converging crises – including climate change, biodiversity loss, food and water scarcity, and energy inequity – the E&S consulting sector is ideally positioned to grow in scale, scope and stature as its supports industry, governments, the finance sector and society at large, to find solutions and foster innovative collaborations," commented Liz Trew, Environment Analyst director & cofounder.

"We are at a critical inflection point, but how the sector rises to the synergistic challenges of sustainability & ESG integration alongside digital transformation and other 'future of consulting' disrupters, will be critical in determining how successful it will be in leading the sustainable transition."

Make way for the new ‘Big 4’

Our industry rankings, based on global E&S revenue figures for FY2020/21, show that a new overall market leader has ascended to the top spot this year. Jacobs boasts a c7,000-strong contingent of E&S consulting professionals with annual revenues totalling $2.80bn, equivalent to a 7.2% share of the total market. A company insider revealed to Environment Analyst that Jacobs was able to accelerate its performance in the E&S space in spite of the challenging market conditions largely thanks to the establishment of its ‘Sustainability and Climate Action’ segment, which has helped facilitate successful engagement across the $14bn group’s diverse engineering, design and technology markets; and as such "it was able to broaden the consulting and advisory element focused on clean energy, operational decarbonisation, net zero building, infrastructure adaptation and nature-based solutions".

Jacobs is set to gain a further boost to its position in next year’s E&S consulting rankings thanks to its recent "PE-style" investment in the UK-based management consultancy PA Consulting, allowing access to a further pool of climate response and sustainability experts globally.

However, if Canadian-headquartered WSP completes the two major acquisitions it announced this year – those of fellow ‘Global 30’ E&S players RPS and Wood Environment & Infrastructure (E&I) – then Jacobs’ position as market leader is likely to be a fleeting one. WSP has made no secret of its desire to attain the premier position in this space and has become a prolific acquirer of companies with E&S capabilities. Industry M&A data presented in the report identifies WSP as the leading industry acquirer over the last five years, with the firm having added as many as 18 familiar industry brand names including Golder, Ecology & Environment Inc, Opus and Louis Berger.

In fact, Jacobs and WSP join AECOM and Tetra Tech in a unique club of four now able to claim a market share in the bracket of 6-8%, which is double that of their closest rivals (namely, Arcadis, ERM, Ramboll, Wood, HDR and Stantec inc. Cardno, which complete the sector’s top ten). The report suggests the E&S ‘Big 4’ have accelerated away from the rest of the pack only in the last two years, driving the sector towards the next stage of maturity, having also moved quicker than other multidisciplinary consultancies in the G30 in putting sustainability at the front and centre of their group strategies and business models.

At EA’s recent Global Business Summit our research and operations director Ross Griffiths postulated that the rise of the sector’s new Big 4 indicates that it is following the classic industry lifecycle consolidation curve whereby businesses "drive aggressive M&A programmes (with the strongest performers swallowing up the weaker), look to financing on a grand scale, focus laser-sharp on profitability, and will typically experience growing pains as they expand at a rapid rate".

Skills in demand

One of the main challenges the Global 30 firms and others in the industry face – partly as a result of the proliferation of ESG & sustainability service providers across the professional services ecosystem – is being able to resource the talent (and then retain it) to deliver on the projected levels of demand, in the more traditional, technical environmental disciplines such as ESIA and contaminated site assessment/remediation, as well as the high-growth strategic areas of carbon accounting, nature-based solutions, sustainable business transformation, and green finance. EA’s report identifies the need for at least another 75,000 E&S consulting professionals worldwide to meet our market projections by 2025, a feat which will certainly require some innovative thinking as debated at EA’s recent Global Business Summit.

Want to know more about our market report and industry data?

The full c140-page report and data package offers a unique window on the E&S consulting market dynamics and is available only to Environment Analyst Strategic Members*. It includes: an executive summary; industry rankings tables, benchmark data and KPIs (including year-on-year growth, average contract value, revenue per head and profitability); revenue breakdowns by company, region, service area and client sector (for the latest FY2020/21 year and a decade of historic data); industry M&A transaction & structure analysis; and forecast market growth by region, client sector and service area to 2025.

It is researched and written by EA’s expert team of analysts based on our annual questionnaire process and rigorous engagement and verification programme working with the Global 30 companies (and wider top 100 firms).

New report features

We’ve made some exciting changes to this year’s edition to enhance the data analytics featured in Environment Analyst’s flagship market intelligence report, including:

- The addition of seven new profiled firms to our ‘Global 30’ line up and industry rankings tables (with Anthesis, Arup, Kleinfelder, NV5, Montrose, RSK, Woodard & Curran joining the other Global 30 firms: Advisian/Worley, AECOM, Antea Group, Arcadis, Cardno (now part of Stantec), ERM (Environmental Resources Management, GHD, HDR, ICF, Inogen Alliance, Jacobs, Mott MacDonald, Ramboll, Royal HaskoningDHV, RPS, SLR, SMEC, Stantec, SNC-Lavalin, Sweco, Tetra Tech Inc, TAUW, Wood and WSP)

- A breakdown of the Global 30’s E&S consulting revenues by our new taxonomy of service areas (rising from 5 to 13 in total), now including air quality, climate mitigation & energy efficiency, climate resilience & adaptation, ecology & biodiversity, ESG & sustainability strategy, and heritage & culture (...and more)

- A breakdown of the Global 30’s E&S consulting revenues by our new taxonomy of client verticals (rising from 6 to 15 in total), now including buildings & real estate, fossil fuels, renewable energy, transport, water & wastewater (...and more)

- A more granular lens on the geographic breakdown of global E&S consulting revenues, staff distribution and regional revenue per head based on the Global 30 (including segmented revenues for Australia/New Zealand, Canada, China, India and the US)

[*Our forecast model is based on projected underlying market growth rate trends which do not directly factor in global or regional inflation projection per se. However, the forecasts do take account of the budgets and targets consultancies themselves have set and expressed to us in our recent Future of Consultancy Member Survey (which means fee rate inflation will be one of many factors reflected)].

*If you are not a Strategic Member of Environment Analyst and are interested in obtaining a copy of the report, Global Environmental & Sustainability (E&S) Consulting Strategies & Market Assessment – Overview & Data Pack 2021/22, please contact Lisa Turner (lisa.turner@environment-analyst.com)