Environment Analyst’s latest annual state-of-the-industry report, ‘Global Environmental & Sustainability (E&S) Consulting Strategies and Market Assessment Overview 2022/23’ (plus accompanying data pack), is now published. The study, based on statistics compiled for 32 of the leading international E&S consulting firms (together accounting for just shy of 60% of total global revenues) and EA’s unique market model, reveals an industry that is surging post-pandemic.

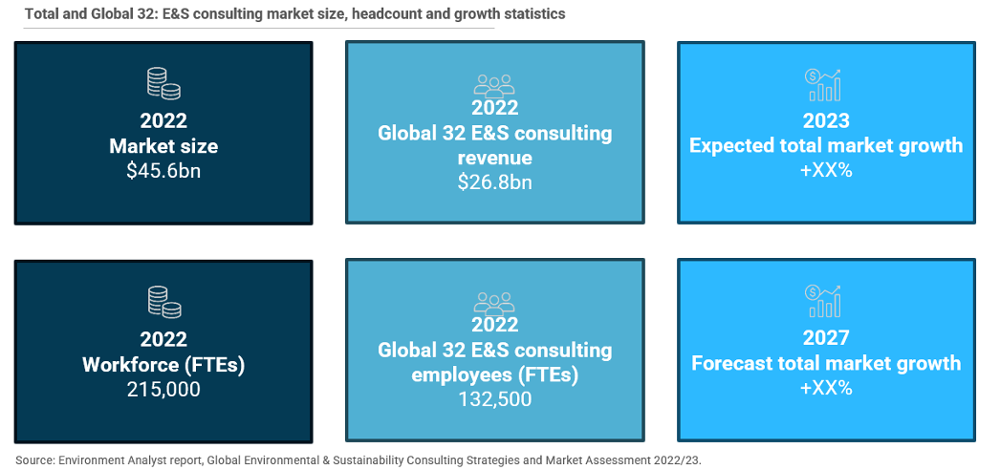

It achieved growth of over 16% in 2022 – almost double that expected at the time of our prior market assessment – to reach $45.6bn.

A double-digit increase is expected again in 2023, particularly as strong momentum carries through in the climate change & energy services area thanks to the groundswell surrounding net zero and clean energy transition policies and funding streams.

Another significant growth factor identified in the report is the strong drive amongst the E&S consulting sector’s top-tier players to expand and consolidate their position through a record level of acquisitions, with the ‘Global 32’ firms responsible for more than 250 M&A deals involving E&S consultancies from the start of January 2020 to the end of June 2023.

WSP completed two of the largest and most impactful industry transactions during this period, acquiring Golder and Wood’s Environment & Infrastructure (E&I) business in addition to a clutch of smaller E&S consultancies in several different countries, helping propel the firm to the industry’s pole position for the first time. That said, there is very little in it between the global E&S consulting’s dominant ‘Big 4’ – WSP, AECOM, Tetra Tech and Jacobs – with these firms almost neck and neck in terms of market share.

A further trend behind expanding market opportunities is the ‘Great Reshuffle’ (as originally referenced in LinkedIn’s Global Green Skills Report 2022). In the context of this industry, the Great Reshuffle perfectly describes the growing penetration of E&S and environmental, social & governance (ESG) expertise throughout the leading multidisciplinary firms’ wider business activities, as sustainability is prioritised through all stages of client projects and investment programmes, and via the consultancies’ own growth strategies, employee upskilling, business culture and annual reporting disclosures. What this means in terms of the surge in E&S consulting revenues as a proportion of their group business and the evolution of services towards ESG and sustainability integration is explored in depth in the report.

But against these market tailwinds, the report warns of potentially more turbulent times ahead as traditional market constituents contend with the proliferation of digital start-up decarbonisation and ESG analytics platforms, the growing interest of major tech firms, management consultants and other professional service companies in the space, as well a deteriorating global economic outlook and an ESG/net zero backlash. Yet even with annual growth slowing slightly from that achieved most recently, EA’s market model forecasts an explosive revenue increase of almost 50% over the next five years to 2027.

Environment Analyst finds a total addressable market value of approximately three times its current size as other regional markets move towards the level of E&S consulting demand/spend of the largest and most mature North American market (which currently accounts for 48% of the global total).

Members may download the report and data pack here to help understand the market revenue breakdowns and forecasts at a granular level, in terms of the leading companies, geographical distribution, and key client verticals and E&S consulting service areas. Non-members can view a report sample here.

[Forecast figures available in full member-only report]

About this report

The full 50-page report and accompanying Excel data pack offer a unique window on the E&S consulting market dynamics and are available only to Environment Analyst Core and Leader Members. The package includes: an executive summary; industry rankings tables, benchmark data and KPIs (including year-on-year growth, average contract value, revenue per head and profitability); revenue breakdowns by company, region, service area and client sector (for the latest FY2022 year and prior decade of historic data); industry M&A transaction & structural analysis; and forecast market growth by region, client sector and service area to 2027.

This report was researched and written by EA’s expert team of analysts based on our annual survey process and rigorous engagement and verification programme, working with the Global 32 companies (and wider top 100 firms). The accompanying Competitor Profile Series for the Global 32 companies are available for Environment Analyst Core and Leader Members to access here.

If you are not a Core or Leader Member of Environment Analyst and interested in obtaining a copy of this report, please contact Lisa Turner (lisa.turner@environment-analyst.com).