- M&A activity within the E&S consulting sector is intensifying, with an increased focus on enhancing the value proposition through digitisation and ESG advisory services.

- Investors are willing to invest in digital tools that ensure credibility and operate in synergy with consulting services.

- The move towards ‘total sustainability solutions’ requires a full spectrum of services, with M&A target emphasis moving to social impact and governance capabilities (i.e. the ‘S’ and ‘G’ in ESG).

The decarbonisation trend and growing uptake of corporate net zero targets, coupled with the need to manage huge volumes of ESG data and the rise of new AI-assisted tools and platforms, are promoting a huge shift in the environmental & sustainability (E&S) consulting industry — an "era of transformation" as Environment Analyst dubbed it in our latest global market assessment report. Unsurprisingly perhaps then the volume of merger and acquisition deals undertaken within the industry post-pandemic has jumped significantly as traditional technical-based consultancies seek to adapt to this brave new world.

Here, in the third and final instalment of a special series of reports inspired by a recent Environment Analyst webinar panel discussion (‘Impact of Mergers, Acquisitions & Financial Partnership Models in the Environment & Sustainability Consulting Sector’), we explore how M&A activity is shaping next-generation environmental service solutions.

When asked what the sector should focus on in the next five years, the panellists — which included consulting business leaders, as well as investors and financial advisors — agreed on the importance of addressing niche service offerings to create a more joined up and rounded expertise to help clients in their holistic approach to ESG and sustainability. At the same time, they agreed it would be equally imperative to have the digital tools at hand to measure the ESG impacts and quantify progress in sustainable delivery, ultimately accelerating the transition to a low-carbon future.

Panellist Tristan Craddock, global M&A director at Anthesis Group, underlined the sense of urgency and need to be able to respond rapidly as client needs evolve, noting that "going forward [Anthesis] will be looking at identifying the gaps in the sector and aiming to fill them at speed, whilst creating the biggest impact — likely to be via niche specialist M&A".

Historically, acquisition strategies among industry leaders tended to be more about increasing market share and geographical expansion. But more recently, strategic M&A is being used as a means to address the need for digitally enhanced technologies and to offer the full spectrum of sustainability and ESG solutions.

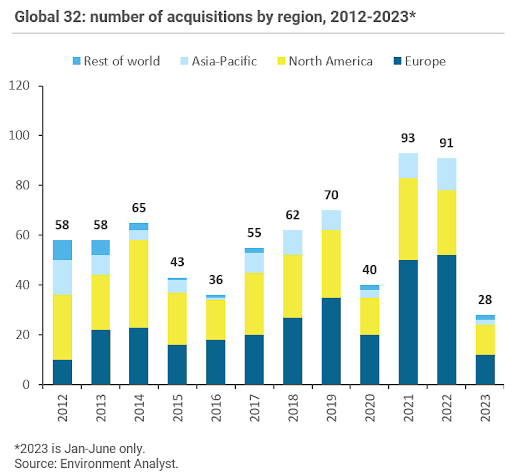

According to Environment Analyst’s recently released Global E&S Consulting Strategies & Market Assessment 2022/23 report, M&A activities have been growing steadily over the last decade, with the 32 sector leaders (‘Global 32’) accounting for 93 E&S-related acquisitions at their peak in 2021 (see figure). Acquisitions related to digital solutions accounted for 28% of the total M&A deals made that year, while ESG advisory accounted for another 26% — so for over half of all the transactions combined.

Leveraging M&A for digital enablement

The consensus among the EA M&A webinar panellists was that there is an increased demand for digital enablement and efficiency tools within the consulting industry. There has been a proliferation of tech-based start-ups and standalone software products filling the market with "flashy new platforms", piling on the pressure for consultancies to develop their own solutions.

However, Rupert Brown, senior investment director at Palatine Private Equity, explained that investors are looking for "substance" in the digital tools they look to invest in, i.e. they need to add credibility, and knowledge and operate in synergy with consulting services. Furthermore, it is this magic combination of advisory expertise plus digital offering which unlocks premium valuations, explained the panellist Stephen Grant, director at boutique investment bank and knowledge economy M&A specialist Equiteq.

During the discussion, it was suggested that there are three main pathways to digital transformation for industry constituents to choose from, the three 'B's – buy, build in-house, and/or borrow (partner).

Anthesis has been developing digital tools since its inception ten years ago by leveraging its in-house tech experts. Tristan Craddock agreed that operability defines the real value of a digital tool, whilst it is also only as good as the historical data which it is based on, which his company leans in on. Although it may be cheaper to develop tools internally, the challenge is the pace at which this can happen in a small to mid-size consultancy compared to specialist tech companies or multidisciplinary consultants with large dedicated teams. Thus, it can be tricky to meet the fast-evolving market demands, which can make the buying (acquisition) route appealing.

On the other hand, acquiring digital tools can be expensive, but viewing it in terms of strategic long-term value creation is the key. "[We are] trying to make sure the digital business is doing the heavy lifting of the more repetitive work", explained Craddock. As such, Anthesis recently invested in the Colombian digital sustainability specialist ConTREEbute and its ESG data focused software-as-a-service (SaaS) tool MERO, which helps corporate clients to consolidate and manage their data for better sustainability reporting. He said this was an example of an acquisition to help Anthesis rapidly close the gap towards capturing "full-scale ESG data".

Meanwhile, SWCA Environmental Consultants leverages its chief technology officer (CTO) to strategically hire leads to develop solutions internally, from drone and AI applications to remote sensing database development. But panellist Robert J Kloepfer, global strategy management officer at SWCA, said the firm is also open to other pathways: "There is also room for partnerships, where small providers can fill niches and help be more effective in delivery without acquiring them, just by working with them".

In fact, ‘borrowing’ the tech via joint ventures and strategic partnerships seems to be highly en vogue, with new pairings reported in the Environment Analyst newsflow on a weekly basis. This year, the global pure-play sustainability consultancy ERM has announced several tech-driven collaborations, including with Google Cloud (to provide data-driven sustainability advisory and delivery services to ERM’s clients), Salesforce (to provide a joint decarbonisation offering), Planet Labs (whose satellite imagery will help enhance ERM’s climate risk, greenhouse gas monitoring and other services), and Belgium-headquartered Greenomy (to help speed up and scale sustainability reporting in line aided by generative AI).

Bringing the ESG advisory offer up to speed

The consulting engineering and professional services industry at large is currently undergoing a ‘Great Reshuffle’ of skills and solutions — with ESG advisory and sustainability expertise becoming a critical element penetrating all stages of client projects, investment programmes, business growth and culture, as well as annual reporting disclosures.

Hence, clients are now more often seeking an "added value, full-spectrum consulting offering", which as the webinar panellists noted, they are willing to pay a premium for. "When you acquire different kinds of services you need to look at what you are targeting for the clients, what are the clients getting from you in terms of the value to their business, and what is the package of advice you're providing," commented Kloepfer.

SWCA’s recent acquisition of ALO Advisors LLC, a sustainability advisory SME based in Florida, has given SWCA the capability to provide end-to-end, full lifecycle support guiding clients through the ‘why—what—how’ to implementation. Kloepfer explained that the addition of ALO has strengthened SWCA’s strategic management consulting offering, specifically ESG advisory services, added to its existing strong technical and scientific offerings. "The ability to call on technical services that we have acquired and make them part of the holistic view of [client’s] company allows us to charge more for our services," he said.

Similarly, Anthesis’ recent acquisition of Wallbrook has rounded out the former’s ESG offering with governance and social expertise (focused on regulatory, ethics and anti-corruption). It will enable the consultancy to offer expertise across "all ESG factors" together with "the cohesion required to tackle regulations such as the EU's CSRD".

PE-backed SLR has also been leveraging strategic M&A to improve its impact-led ESG advisory and management consulting offering. Carnstone, a London-headquartered global sustainability and ESG consultancy, will help SLR’s clients to address ESG challenges throughout their supply chain, while IBIS — an ESG advisory specialist headquartered in Kent, UK — adds a sizable 100-strong team with expertise in sustainable finance across the globe.

Speaking from an investor’s perspective, Palatine's Rupert Brown surmised that "a good ESG decision will also be a good long-term returns decision, the two things come in parallel and drive each other," underscoring that ESG-focused acquisitions are highly appealing to private equity. A recent BCG report found that ‘green M&A deals’ can be a cost-effective approach to drive environmental transformation and simultaneously increase shareholder value over the short- and long-term — hence offering a double win for E&S consultancies and their investors.

---

This is the third of a three-part series. Part one can be found here and part two here.

View the panel discussion, 'Impact of Mergers, Acquisitions & Financial Partnership Models in the Environmental & Sustainability Consulting Sector,' on demand via this link.