Despite recession risk and volatile partisan politics, the US environmental & sustainability (E&S) consulting market is experiencing a period of unprecedented strength, according to Environment Analyst’s latest research report.

At just over $14.1bn, it is the largest single market for these services worldwide, accounting for 36% of global E&S consulting revenues, according to our industry figures (which are based on a comprehensive survey of the leading firms’ performances in FY20/21).

Global Subscribers** can download the full 75pp report here

Major legislative successes and the re-emergence of the US as a global climate action player are helping create a burgeoning pipeline of projects across multiple industries and sectors. Large-scale renewable energy generation and transmission architecture are helping drive demand for environmental permitting and impact assessment services. Oil and gas firms are opting to channel soaring profits into the remediation and sale of non-strategic assets. In the water and wastewater industry, the looming PFAS problem is forcing local governments and utilities to engage with solutions for testing and clean-up.

Meanwhile, an ever-expanding array of regulatory initiatives and an increasingly vocal client base are pushing companies hard on ESG. Here the playing field is becoming very crowded, even though it is still a relatively nascent part of the E&S services space. Tech firms are offering sophisticated solutions for emissions measurement and life-cycle assessment. Management consultants still have the ear of C-suite executives eager for cutting-edge sustainability strategies. But, as the report suggests, environmental consultants from the traditional engineering and design ilk still have ample opportunity to leverage their implementation expertise to earn a seat at the table and compete with higher margin solutions.

Despite an optimistic outlook, with overall market growth projected at 7-8% for both the current year and next year, there are clear challenges on the horizon. The war for talent shows little sign of abating. Retaining skilled staff is hard enough, but the industry will need tens of thousands of new participants to tackle the massive increase in projects expected. Political, regulatory and economic uncertainty complicates the picture. A dramatic ramp-up in government funding for climate action is more or less assured, but legal challenges to key policy decisions are likely to increase.

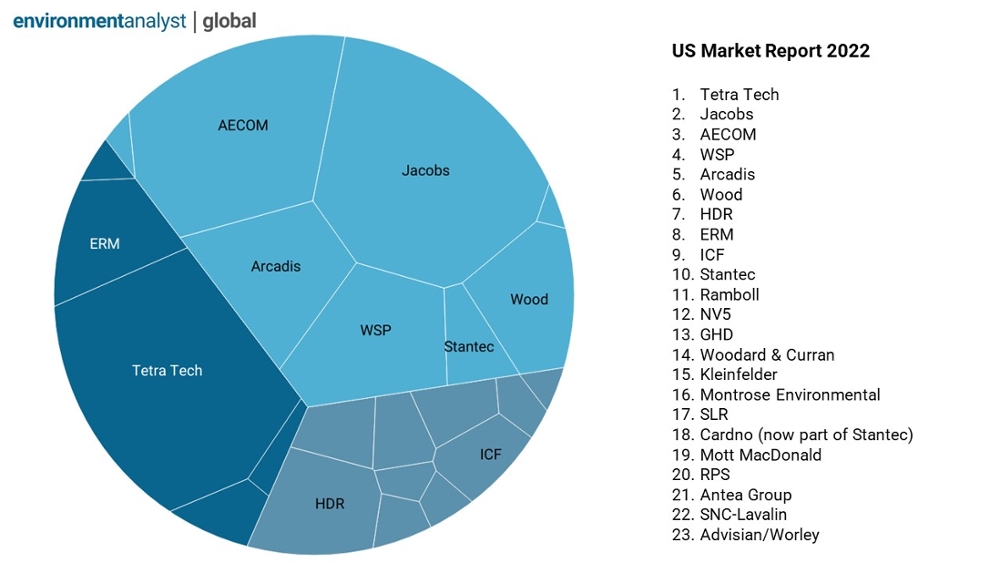

The report explores each of these themes and many more, drawing on a series of interviews conducted with senior executives from across the US E&S consulting sector and also detailed survey data based on 23 of the leading service providers (together representing approximately 70% of the entire market). These firms employed a total of 38,845 E&S consulting professionals in the US in FY20/21 and serviced in excess of 116,000 individual contracts that year. Average contract values in the US market were found to be almost double that observed for the global E&S consulting industry at large, whilst the average revenue per head achieved by these firms in the US was 45% higher than the same for the wider global market.

The five leading service providers (in order of US E&S consulting revenues that year) are revealed as: Tetra Tech; Jacobs; AECOM; WSP; and Arcadis. These companies boasted a combined market share of 47% in FY20/21 and are set to claim an even greater slice of the pie thanks to their M&A activity in recent months, notably that of WSP and Tetra Tech*.

Figure 1. The 'US E&S 23' market leader rankings, FY20/21

Source: US Environmental & Sustainability (E&S) Consulting Market Assessment report data (where 23 firms profiled represent ~70% of the total market); top ten firms indicated on graphic

Headline findings

- Market trajectory: US E&S consulting market growth was constrained at the height of the CV-19 pandemic in 2020 (reflecting the company constituents' figures for FY20/21) to 3.1%, but our market model figures suggest a strong bounce back to 8.8% the following year (FY21/22). Market model projections going forward are slightly lower than this reflecting the deteriorating economic backdrop, but demand is expected to remain strong thanks to the tightening regulatory frameworks and standards impacting the private sector, and federal budget commitments flowing through to the public sector.

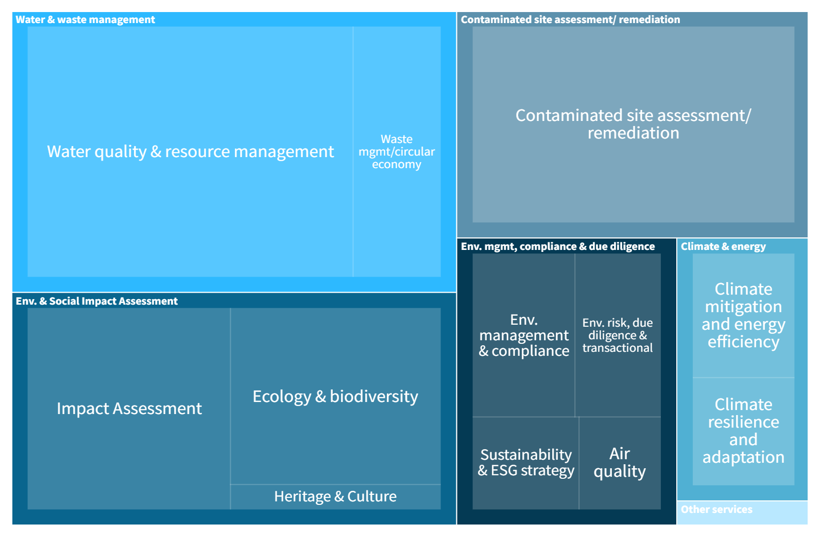

- Service areas: The traditional site-based services involving contaminated site assessment/remediation, impact assessment, and water and waste management account for over three-quarters of the sectoral revenues based on the 23-strong cohort, whilst dedicated climate change & energy and ESG & sustainability services currently represent less than 12% of the total. However, the latter are widely acknowledged to be high-growth areas where innovative service offerings and collaborations between service providers from across the professional services ecosystem are emerging in response to the rapidly evolving decarbonization and net zero agenda.

- Client sectors: In terms of industry verticals, the public sector accounted for a dominant share of E&S consulting revenues, at over 37%, followed by energy & utility firms at approximately 32%. However, large-scale infrastructure projects are expected to become increasingly important thanks to the landmark IIJA and IRA legislation, particularly in the transport sector, and through a growing focus on climate resilience and sustainability. At the same time, private sector demand for ESG & sustainability services is soaring, driven by an emerging array of initiatives, regulatory frameworks and growing pressure from stakeholders and employees.

- By state: California was found to be the single largest source of E&S consulting income for consultancies that supplied state-level revenue data, accounting for more than double that of each of Texas, Florida and Virginia – the next largest state-level markets. On average their top ten state markets accounted for almost two-thirds of the peer group’s US E&S consulting revenue total.

- Staffing: At group level, the 23 firms analyzed saw a double-digit percentage point drop in aggregate US staff numbers across all of their activities through FY20/21 (reflecting streamlining, divestments and/or the impact of pandemic layoffs), but their E&S consulting practices grew by an average of 5.1% – including both organic and acquisitive additions. That said, 9 of the 23 companies did see a reduction in E&S consulting FTEs that year, highlighting that for some E&S consulting players the pandemic fallout was much more pervasive.

Figure 2. US E&S 23: Sectoral revenues by service area, FY20/21 (representative infographic)*

Source: EA’s US Market E&S Consulting Assessment report 2022 (based on date provided by 21 of the 23 profiled firms)

Want to know more about our new US market report and industry data?

Our brand new, first-of-its-kind, 75-page report and data set offers a unique window on the US environmental & sustainability consulting market dynamics and is available only to Environment Analyst Global Subscribers**. It includes: an executive summary; market overview and industry rankings tables, benchmark data and KPIs by company (including year-on-year E&S revenue growth, average contract value, revenue per head and staffing changes); market revenue breakdowns by service area, client sector, and by top ten states for the latest FY20/21 year; and market growth forecasts to FY25/26.

It also presents our analysis of how the latest government policy and regulations (including the IIJA and IRA, and for PFAS and ESG) and developments in the corporate and financial world, are shaping demand for specialist E&S consulting services.

It is researched and written by EA’s expert team of analysts based on our annual questionnaire process and rigorous engagement and verification programme working with the ‘US E&S 23’ peer group companies, and wider Top 100 global firms.

Companies profiled and featured in this report series and industry data tables include: Advisian/Worley, AECOM, Antea Group, Arcadis, Cardno (now part of Stantec), ERM (Environmental Resources Management), GHD, HDR, ICF, Jacobs, Kleinfelder, Montrose Environmental, Mott MacDonald, NV5, Ramboll, RPS*, SLR, SNC-Lavalin Group, Stantec, Tetra Tech, Wood*, Woodard & Curran and WSP.

*Since the report data was compiled, the bulk of Wood’s global E&S consulting business was acquired by WSP in Q3 2022; and RPS has also entered into an agreement to be acquired by Tetra Tech (which is expected to complete by the end of 2022).

Learn more at our upcoming webinar

Join our webinar on 12 January at 11 am EDT / 8am PT / 4pm GMT and hear Ross Griffiths, Managing Director at Environment Analyst, share the headline findings from Environment Analyst’s latest US environmental & sustainability consulting market assessment.

Following Ross’ presentation, a panel of industry representatives from Jacobs, Arcadis and TRC will present their perspectives on key trends highlighted by the report, sharing insight into how their companies are responding to changing market dynamics and helping their clients to do the same.

----

**If you are not a Global Subscriber of Environment Analyst and are interested in obtaining a copy of the report, US Environmental & Sustainability (E&S) Market Assessment 2021/22, please contact Lisa Turner (lisa.turner@environment-analyst.com)